- Bullseye Trades

- Posts

- A major catalyst just hit the presses *this morning* 🗞️

A major catalyst just hit the presses *this morning* 🗞️

No wonder a company insider has been scooping up shares

Issuer-Sponsored Content from OKYO Pharma*

Most people focus on products and charts, but execution comes from leadership. I’m watching a stock that just announced a CEO swap this morning, and it’s someone who’s actually built and commercialized things in this space before. The stock already had momentum and this could be just what it needs for another leg up.

TODAY’S TOP ALERT!

OKYO Pharma (Nasdaq: OKYO)

👉 OKYO is TODAY’S #1 ALERT* 👈

Hey Folks, please note Jeff Williams will be sending out the Bullseye trade today so if you are member be looking out for that!

I hope you’re fully rested from the holidays and looking forward to a fantastic year in the markets 💪🏻.

I took some time off from my “tactical trade” alerts for the holidays, but Friday I picked things up in earnest.

One of the stocks I alerted roared as high as 42% intraday and ultimately closed the day up 26% (and it’s up again in the pre-market as of this writing).

The other stock I alerted had a late-day surge that I think could still be in its early innings…

💥Go ahead and pull up OKYO Pharma Limited (OKYO) on your trading platform.

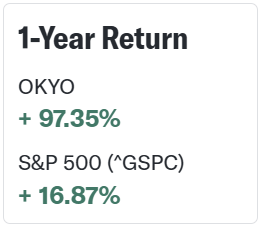

You’ll see this one has been a great performer over the past year — its 97% gain has bested the S&P 500’s 17% gain nearly sixfold:

The stock surged more than 7% on Friday into the close, breaking through recent resistance and tracing into the levels it was at in early-to-mid November.

It’s now up about 17% over the past month, and I think the press release out this morning could be just what it needs for another leg up.

The company is advancing a topical drug for the treatment of Dry Eye Disease (DED), and this morning, it revealed that perhaps the best possible candidate will now serve as its CEO.

Robert J. Dempsey has more than two decades of global ophthalmology experience…

He “previously served as Group Vice President and Head of Global Ophthalmology at Shire, prior to its acquisition by Takeda, where he led the divestiture of Xiidra®…. The sale of Xiidra® to Novartis in 2019 included $3.4 billion upfront and up to an additional $1.9 billion in potential milestone payments.” [emphasis added]

Xiidra was “the first FDA-approved therapy indicated for both the signs and symptoms of dry eye disease and went on to become one of the top-selling branded dry eye treatments globally.”

Mr. Dempsey’s experience also includes “direct management responsibility and commercial oversight for Restasis®,” another treatment for DED.

The takeaway is that Mr. Dempsey “has been directly involved in the commercialization of two of the most successful blockbuster dry eye therapies… and now brings that same execution and commercial discipline to advancing urcosimod [OKYO’s lead candidate] toward becoming the first therapeutic for neuropathic corneal pain.”

This is huge news for OKYO, and I’m watching it closely today to see if it’s the catalyst for the stock’s next leg up.

👉 OKYO is TODAY’S #1 ALERT* 👈

In the meantime, here are some notes from my research about this interesting company…

To begin with, OKYO has an excellent website.

I’ve looked at tons of clinical-stage biopharma sites, and most are so full of jargon that it’s hard to see how any regular investor could understand them.

Maybe that’s their goal??

OKYO, on the other hand, does a great job of explaining their science, leadership, and investment opportunity.

One of the company’s main targets is Dry Eye Disease (DED), which is expected to reach a $6.57 billion global market value by 2027.

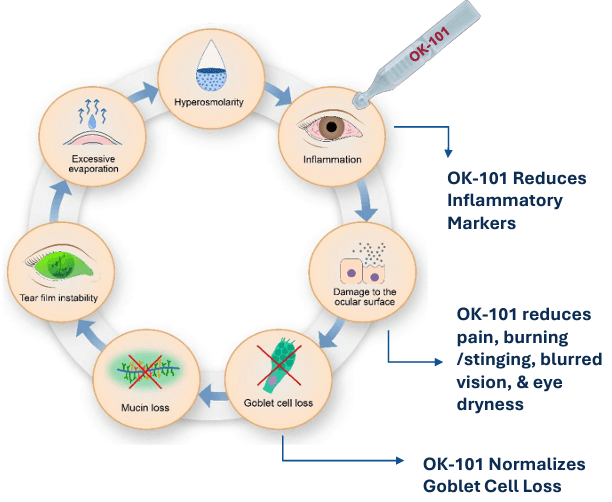

DED results when the eyes don’t produce enough tears, causing poor lubrication that can lead to redness, grittiness, burning, blurring, and eye fatigue.

It’s a common condition, with approximately 38 million cases in the US and 700 million cases worldwide.

It affects over 35% of the population aged 50+, and two-thirds of DED patients are women.

OKYO is rapidly advancing its lead candidate, urcosimod — a topical drug designed to control inflammation and pain in the eye.

Urcosimod was formerly known as OK-101 before it received its United States Adopted Name (USAN) last February.

The company began a Phase 2 trial for urcosimod as a treatment for DED in May 2023 and revealed ”extremely encouraging” topline data from the trial in January 2024.

The trial found that urcosimod had a “highly favorable tolerability profile” and achieved statistical significance for multiple “sign” and “symptom” endpoints.

Specifically, the drug proved superior to the placebo for “total conjunctival staining” — a sign of DED — and for burning/stinging and blurred vision.

The company said that “To our knowledge, there are no FDA approved DED drugs that have been shown in clinical studies to improve conjunctival staining.”

OKYO now plans to advance urcosimod to a Phase 3 trial with the goal of developing a “highly differentiated dry eye product to help patients underserved by current treatments.”

In the course of the Phase 2 trial, researchers also found support for the potential of urcosimod to treat neuropathic corneal pain (NCP) — “a severe, chronic, and debilitating disease for which there are no approved commercial treatments currently available” [emphasis added]

As a result, OKYO is pursuing a parallel focus of urcosimod for that disease.

In February 2024, the FDA “cleared OK-101 as its first Investigational New Drug (IND) application for the treatment of NCP” and OKYO began a Phase II trial for that purpose that October.

The principal investigator of the trial is Dr. Pedram Hamrah of Tufts Medical Center — a renowned expert in NCP.

As OKYO CEO Gary Jacob, Ph.D. explained in an excellent interview, the company has a "tremendous opportunity from a commercial standpoint” by pursuing a drug to treat a major unmet medical need. This “can lead to partnerships with big pharma and the kind of final merger acquisition outcome.”

Last April, OKYO announced pivotal news of the early closure of its Phase 2 trial…

The company had planned to run the trial through the end of the year, but the early data was so promising, OKYO decided “to access the currently masked data and use it to plan its expanded development program.”

A number of trial patients even requested continued compassionate use of urcosimod.

Last May, OKYO announced that the FDA granted urcosimod a Fast Track Designation for the treatment of NCP, which will allow more frequent meetings with the FDA as well as “eligibility for Accelerated Approval and Priority Review if relevant criteria are met, and a potential Rolling Review of the New Drug Application (NDA).”

Then in July, OKYO revealed its “strong phase 2 clinical trial results for urcosimod to treat neuropathic corneal pain”

The company noted that “75% of patients treated with 0.05% urcosimod in this group achieved greater than 80% improvement in pain severity based on [Visual Analogue Scale] scores.”

Top-line data that strong for a treatment that targets an unmet medical need can be a total game-changer for a small company like OKYO.

Then just last month, the company revealed new data that indicated “favorable changes in corneal nerve structure which were not observed in the placebo group.”

“These early nerve regeneration signals are highly encouraging and biologically meaningful,” said principal investigator and University of South Florida ophthalmology professor Dr. Pedram Hamrah.

“The fact that we are seeing consistent directional improvements in both nerve fiber count and nerve fiber length, suggests that urcosimod may not only reduce pain but also support the restoration of corneal nerve architecture.”

It’s worth noting that CEO Gary Jacob purchased 10,000 OKYO shares in January 2025, a few months after the start of the NCP trial.

He also purchased 210,000 shares on October 16, 82,000 shares on November 21, and 27,000 shares on December 3, and 24,500 shares on December 15.

That’s a great, recent sign of insider confidence.

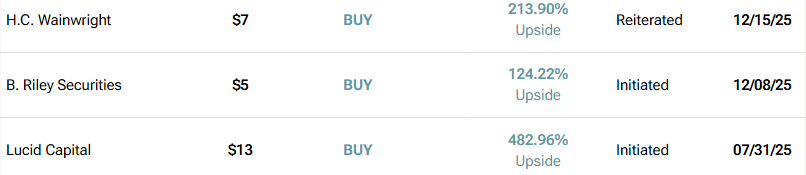

At the same time, the analyst firm B. Riley Securities recently initiated coverage with a $5 price target — 124% upside from its current price — and the firm H.C. Wainwright reiterated a $7 price target for 213% upside:

For your own research, I recommend starting with the company’s website and its November 2025 corporate presentation.

As always, be sure to approach your trading in a responsible manner. Trading is very risky, and nothing is ever guaranteed, so never trade with more than you can afford to lose.

Please read the full disclaimer at the bottom of this email as well so you are aware of our compensation and other conflicts of interest, as well as additional risks and considerations. Always have a well-thought-out game plan that takes your personal risk tolerance into consideration.

Bottom line: OKYO closed Friday up 7% (and hit a 17% gain for the prior month), and just this morning announced a new CEO who was “directly involved in the commercialization of two of the most successful blockbuster dry eye therapies.”

I have a feeling investors will be very excited about the news, and I’m watching OKYO today to see how the stock reacts.

💥Make sure OKYO is at the top of your watchlist!

To Your Success,

Jeff Bishop

*ISSUER-PAID DISCLAIMER: This entity is owned by Sherwood Ventures LLC (SV). To more fully understand any SV subscription, website, application or other service, please review our full disclaimer located at https://bullseyealerts.com/disclaimer/

Just so you know, what you're reading is curated content for which we have received a monetary fee (detailed below) to create and distribute. Let's be clear that investing can be quite the roller coaster as stock prices can have wild swings up and down, so consider those crucial risks before you ever consider trading anything we discuss. Make sure you check out our full disclosure down below for the details on how we were paid, the risks, and why these results aren't what you'd call “typical.”

Just a quick heads up about this ad you're reading—as we’ve said, even though we like the company referenced above, and all the facts we discussed above are true to the best of our knowledge, we are running a business here. To distribute this information and help offset the costs of maintaining our large digital audience, in advance of writing the content above, we have been paid thirty thousand dollars (cash) by bank transfer from OKYO Pharma Limited for advertising OKYO Pharma Limited for a two day marketing program on January 2 & 5, 2026. Before this, we were paid ten thousand dollars (cash) by bank transfer Sica Media for advertising OKYO Pharma Limited for a one day marketing program on July 18, 2025. Additionally, we were paid twelve thousand five hundred dollars (cash) by bank transfer Sica Media for advertising OKYO Pharma Limited for a one day marketing program on June 20, 2025. Prior to this, we were paid twenty five thousand dollars (cash) by bank transfer by OKYO Pharma Limited for advertising for a one day marketing program on January 8, 2025. Previously, we also received paid twenty five thousand dollars (cash) by bank transfer by OKYO Pharma Limited for advertising for a one day marketing program on October 23, 2024. To date, we have received one hundred and two thousand five hundred dollars for advertising OKYO Pharma Limited.

It might seem obvious, but while our client claims not to own any shares in OKYO Pharma Limited, whoever ultimately paid them most likely owns shares. You should assume they are looking to sell some or all of them at any time after we send out this information, which might negatively affect the stock price. We may also buy or sell shares in the company at some point in the future, although neither Sherwood Ventures nor its owners own any shares of the company at this time. Also, keep in mind that due to the sheer size of our audience, if even a small percentage of people decide they want to buy this stock, it could potentially boost interest enough to hike up those share prices and cause a temporary spike, and the opposite is possible as the marketing campaign ends, though that is not always the case.

Now, diving right into OKYO Pharma Limited might sound exciting. But remember, it’s like venturing into the wilderness—be aware that there's exceptional risk involved in trading. This isn't small potatoes we're talking about; you could lose every dime you put in, so always carefully think about what you’re doing. That’s why they call this trading, after all. We're shining a light on the good stuff about the company here, but it's on you to do your homework, make your own calls, and determine a plan for your own trading, hopefully with the help of your professional 1nvestment advis0r.

Oh, that brings us to another crucial point—we're not here to tell you (or even recommend) what you should do with your hard-earned money. We’re simply sharing our non-expert thoughts by highlighting some companies who are paying us and we like that could use some help telling their story to more people. We’re obviously biased in our writing. We’re not here to dig into anything that may be negative about the company; this is advertising, after all! Also, keep in mind that if we make some predictions about the future, these are technically known as “forward-L00king statements” under the securities acts, so take those with a grain of salt. As with all forecasts, they’re not set in stone, often wrong, and we certainly can’t know where the Company’s earnings, business, or share price will be tomorrow or a year from now.

Everything you read from us is all for your education, information, and possible entertainment. While we believe the info is reliable and accurate, we can't wear a cape and guarantee it. Before you jump into anything, make sure to talk it over with a pro—someone you trust who's licensed to give you real advice. To be clear, neither Sherwood Ventures nor its owners, employees, or independent contractors are registered as a securities broker-dealer, broker, 1nvest.ment advis0r (IA), or IA rep’s with the SEC, any state securities regulatory authority, or any self-regu1atory organization.

So, that's the scoop! If you're intrigued and want to learn more about the companies we talk about, hit up the SEC's website to dig into their filings and see the full picture.