- Bullseye Trades

- Posts

- AI earnings are on fire 🔥

AI earnings are on fire 🔥

And a small pharma stock is joining the action

Sponsored by IR Agency and Disseminated on Behalf of Shuttle Pharmaceuticals Holdings, Inc*

Markets RIPPED in October, earnings have been crushing, and November’s setting up for its classic year-end push. I’m tracking a setup that could be in for a solid bounce thanks to an announcement fresh off the presses.

TODAY’S TOP ALERT!

Shuttle Pharmaceuticals Holdings

(Nasdaq: SHPH)

👉 SHPH is TODAY’S #1 ALERT 👈

Good morning, Folks, and happy Monday! (If you’re a Bullseye member, look out for my email just for you at 9:15am.)

We’re coming off a fantastic October for stocks. The S&P 500 climbed 2.3% and the Nasdaq roared 4.7%.

Earnings have powered the push higher. Of S&P 500 companies that have reported so far, 80% beat expectations, including many of the crucial AI stocks.

Historically, November is the best month for the S&P 500, so I’m very excited about what’s ahead, especially as we get closer to Thanksgiving…

The week before Turkey Day is actually when the legendary “Santa Rally” effect begins, and it’s a great time to be in the markets.

Right now, stock futures are looking good as we kick off a new month of trading.

My “tactical trade” idea today is a stock that’s sitting at a very attractive price level right now.

Have a look at the chart for Shuttle Pharmaceuticals Holdings, Inc. (SHPH).

I first alerted this one back in April, and that day it enjoyed a 24% intraday gain.

The stock dipped in June due to a 1-for-25 reverse split and a $4.25 million private placement.

It has had its ups and downs since then, but you’ll see it kicked off October with a 60%+ ramp-up.

That fell off sharply after the company executed an LOI to acquire an AI company “specializing in molecular discovery and drug development technologies.” (more details below)

While investors may be excited about the acquisition, they don’t seem excited that the $10 million deal is being paid in part by shares of SHPH common stock.

This one’s on my radar right now because, just this morning, the company announced a $2.5 million private placement priced above the market — at $4.00 compared to Friday’s $2.97 closing price.

The pre-market is responding as you’d expect, and I think this could be just the stock needed to spark a “bottom bounce.”

Tune into SHPH today to see where it goes!

👉 SHPH is TODAY’S #1 ALERT 👈

The Gaithersburg, Maryland-based company was founded in 2012 by faculty members of Georgetown University Medical Center.

The company’s mission is to develop “novel therapies designed to increase cancer cure rates, prolong patient survival, and improve quality of life.”

Its special focus is on enhancing the effectiveness of radiation therapy (RT).

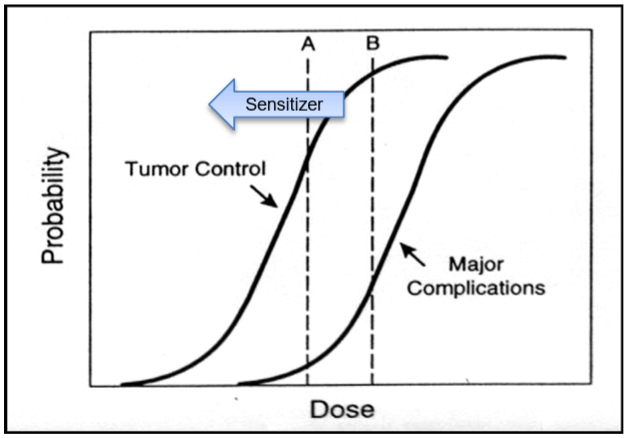

As I’m sure you know, RT can be very successful at defeating cancer. However, oncologists have to limit their dosing because tissues surrounding the cancer are also sensitive to radiation.

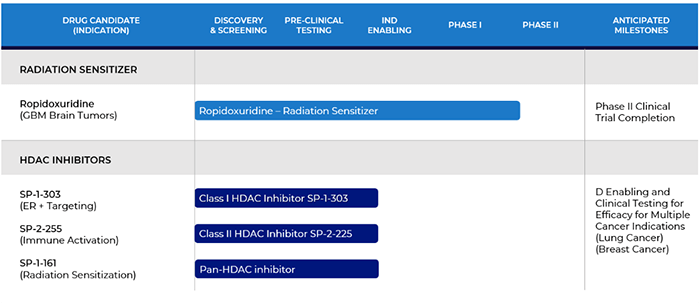

SHPH’s lead candidate, Ropidoxuridine, is an orally-administered cancer radiation sensitizer.

The idea is to reduce the dose of radiation necessary to get control of the cancer, while limiting major complications.

For more on the science behind the candidate, check out this investor presentation.

The company successfully launched a Phase 2 trial in November 2024 for Ropidoxuridine — paired with RT — targeting the most aggressive form of brain tumors: IDH wild-type, methylation negative glioblastoma.

The trial has reached at least 63% enrollment in the initial randomized portion, and 72% of enrolled patients have received all the planned dosages.

SHPH has received an Orphan Drug Designation from the FDA for Ropidoxuridine, which could grant marketing exclusivity if it gets approved.

The company is also developing inhibitors that it believes could activate the innate immune system after RT. To date, they are still in the pre-clinical stage:

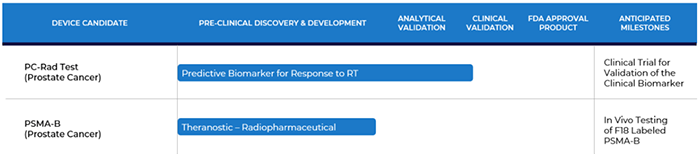

SHPH also has a subsidiary, Shuttle Diagnostics, that is developing the PC-RAD Test — a biomarker blood test that could predict outcomes following RT for localized prostate cancer.

Each year, there are ~268,000 new prostate cancer cases in the U.S., and the global prostate cancer diagnostic market reached $2.83 billion back in 2019.

According to the company, “The key unmet need of the diagnostic market is having a predictive, minimally invasive blood test that provides the clinician and patient with a measurement of the potential success of radiation therapy for their cancer treatment.”

SHPH has an exclusive agreement with Georgetown University to advance the test.

In addition, SHPH has a sponsored research agreement with the University of California, San Francisco to advance PSMA-B as a potential diagnostic and therapeutic for metastatic prostate cancer.

The company announced in April that it filed a provisional patent application related to this diagnostic.

The big news out last month, of course, was the October 9 announcement that SHPH is entering the $3.24 billion AI pharmaceutical market with a non-binding letter of Intent to acquire Molecule.ai.

On October 21, the company entered into a binding term sheet, so it’s looking like a sure thing.

The company says that Molecule.ai has a platform that “enables researchers to shorten development timelines, reduce costs, and increase the likelihood of identifying successful therapeutic candidates.”

It does so thanks to three capabilities:

Molecule Property Prediction and Reasoning

Drug-Target Interaction Modeling

Agentic AI Mode

You can read more about it here.

As you do your own research on SHPH, be sure to check out this corporate update, this spring 2025 investor presentation, and the company website.

And of course, always approach your trading in a responsible manner, remembering that trading is very risky. Nothing is ever guaranteed, so never trade with more than you can afford to lose.

Please read the full disclaimer at the bottom of this email as well so you are aware of additional risks and considerations. Always have a well-thought-out game plan that takes your personal risk tolerance into consideration.

Bottom line: SHPH has dropped since October 9 on investor fears of potential dilution. This morning, the company announced an above the market private placement that could deliver the “bottom bounce” the stock needs.

This is an urgent trade idea, so be sure to get it on your radar ASAP!

To Your Success,

Jeff Bishop

P.S. Please join me at 11AM EST today as I run down this and MORE - LIVE at 11AM EST in Market Masters. All are welcome!

*DISCLAIMER: This entity is owned by Sherwood Ventures LLC (SV). To more fully understand any SV subscription, website, application or other service, please review our full disclaimer located at https://bullseyealerts.com/disclaimer/

Just so you know, what you're reading is curated content for which we have received a monetary fee (detailed below) to create and distribute. Let's be clear that investing can be quite the roller coaster as stock prices can have wild swings up and down, so consider those crucial risks before you ever consider trading anything we discuss. Make sure you check out our full disclosure down below for the details on how we were paid, the risks, and why these results aren't what you'd call “typical.”

Just a quick heads up about this ad you're reading—as we’ve said, even though we like the company referenced above, and all the facts we discussed above are true to the best of our knowledge, we are running a business here. To distribute this information and help offset the costs of maintaining our large digital audience, in advance of writing the content above, we received forty five thousand dollars (cash) from IR Agency for advertising Shuttle Pharmaceuticals Holdings, Inc for a one day marketing program starting on November 3, 2025.

Additionally, we received forty thousand dollars (cash) from IR Agency for advertising Shuttle Pharmaceuticals Holdings, Inc for a one day marketing program starting on April 10, 2025. To date, we have received eighty five thousand dollars for advertising Shuttle Pharmaceuticals Holdings, Inc.

It might seem obvious, but while our client claims not to own any shares in Shuttle Pharmaceuticals Holdings, Inc, whoever ultimately paid them most likely owns shares. You should assume they are looking to sell some or all of them at any time after we send out this information, which might negatively affect the stock price. We may also buy or sell shares in the company at some point in the future, although neither Sherwood Ventures nor its owners own any shares of the company at this time. Also, keep in mind that due to the sheer size of our audience, if even a small percentage of people decide they want to buy this stock, it could potentially boost interest enough to hike up those share prices and cause a temporary spike, and the opposite is possible as the marketing campaign ends, though that is not always the case.

Now, diving right into Shuttle Pharmaceuticals Holdings, Inc might sound exciting. But remember, it’s like venturing into the wilderness—be aware that there's exceptional risk involved in trading. This isn't small potatoes we're talking about; you could lose every dime you put in, so always carefully think about what you’re doing. That’s why they call this trading, after all. We're shining a light on the good stuff about the company here, but it's on you to do your homework, make your own calls, and determine a plan for your own trading, hopefully with the help of your professional 1nvestment advis0r.

Oh, that brings us to another crucial point—we're not here to tell you (or even recommend) what you should do with your hard-earned money. We’re simply sharing our non-expert thoughts by highlighting some companies who are paying us and we like that could use some help telling their story to more people. We’re obviously biased in our writing. We’re not here to dig into anything that may be negative about the company; this is advertising, after all! Also, keep in mind that if we make some predictions about the future, these are technically known as “forward-L00king statements” under the securities acts, so take those with a grain of salt. As with all forecasts, they’re not set in stone, often wrong, and we certainly can’t know where the Company’s earnings, business, or share price will be tomorrow or a year from now.

Everything you read from us is all for your education, information, and possible entertainment. While we believe the info is reliable and accurate, we can't wear a cape and guarantee it. Before you jump into anything, make sure to talk it over with a pro—someone you trust who's licensed to give you real advice. To be clear, neither Sherwood Ventures nor its owners, employees, or independent contractors are registered as a securities broker-dealer, broker, 1nvest.ment advis0r (IA), or IA rep’s with the SEC, any state securities regulatory authority, or any self-regu1atory organization.

So, that's the scoop! If you're intrigued and want to learn more about the companies we talk about, hit up the SEC's website to dig into their filings and see the full picture.