- Bullseye Trades

- Posts

- 🪙 Copper Just Went Parabolic

🪙 Copper Just Went Parabolic

Here’s a play on it...

Sponsored by Sica Media and Disseminated on Behalf of NexMetals Mining, Corp*

Markets have been wild lately, but I’m zeroed in on one mining company that’s got real momentum right now. The Fed will probably stay put, but this stock’s making its own moves — here’s what I’m looking at today.

TODAY’S TOP ALERT!

NexMetals Mining (Nasdaq: NEXM)

👉 NEXM is TODAY’S #1 ALERT 👈

Good morning, Folks,

After their stocks made initial, counterintuitive moves in response to their earnings releases last night, GOOG and TSLA are trading about where you’d expect this morning…

GOOG is up about 3.5% and TSLA is down about 6% as of this writing.

Despite the mixed results, stock futures are up slightly this morning, largely on trade-war optimism.

My “tactical trade” idea this morning is a play off the President’s July 8 announcement of a 50% tariff on copper imports, effective August 1.

The news sent copper prices surging 13% in one day, up to a record high.

The company I’m focused on is a junior miner with a focus on copper.

Go ahead and pull up NexMetals Mining Corp (NEXM) on your favorite trading platform.

NEXM uplisted to the Nasdaq on July 16, hitting a high of $10.35 that day before drawing down until this Tuesday, July 22.

It’s typical for uplisting hype to be followed by sell-offs, so this doesn’t surprise me.

The stock began rebounding Tuesday, though, rising 15% from its low that day into the close…

Yesterday, it jumped another 11% on the day.

The stock has solid momentum right now with very minimal pullbacks, and I’m watching it closely today to see if this breakout continues.

👉 NEXM is TODAY’S #1 ALERT 👈

NEXM is a Vancouver-based mineral exploration and development company specializing in critical metals, particularly copper, nickel, cobalt, palladium, and platinum.

These metals — and copper in particular — are in very high demand, driven by electric vehicles, renewable energy, and electrification. Copper futures are up 41% YTD and cobalt is up 36%.

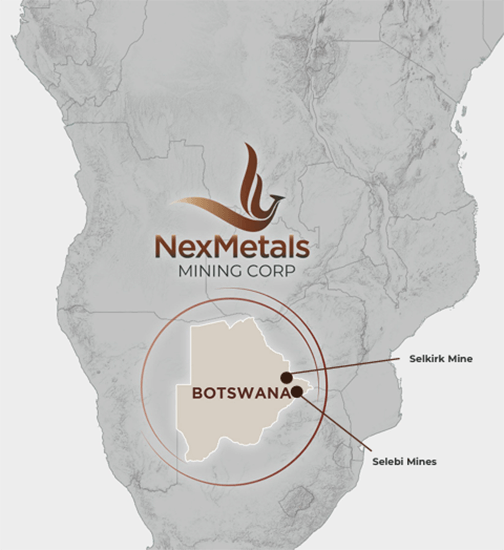

It’s focused on redeveloping past-producing sulfide mines in Botswana, a country known for its political stability, mining-friendly policies, and established infrastructure.

Botswana has a 58-year-running democracy, and in March, NEXM CEO Morgan Lekstrom met with its newly elected president in Washington, D.C.

Originally incorporated as Premium Resources Ltd., the company changed its name to NexMetals Mining Corp. on June 9 to better reflect its emphasis on next-generation metals.

The rebranding coincided with other moves to attract investor attention, including the uplisting to the Nasdaq on July 16 — just last Wednesday.

In 2022, NEXM acquired the Selkirk and Selebi mine projects from bankruptcy proceedings of a prior operator. The mines are in the heart of Botswana's mineral-rich Selebi-Phikwe and Francistown regions.

Selebi produced “26.6 million tonnes grading 0.58% [nickel] and 1.03% [copper]” from 1980 to 2016, while Selkirk operated only briefly in the early 1990s.

NEXM plans to use existing infrastructure — like underground access, shafts, and processing facilities — to fast-track redevelopment.

On August 8, 2024, NEXM revealed its Mineral Resource Estimate (MRE) for Selebi Mine, which included an Inferred resource of 24.7 million tonnes and 3 million tonnes Indicated averaging 2.92% - 3.40% copper equivalent.

And on June 30, NEXM revealed assay results from two 2025 resource expansion holes at Selebi beyond the 2024 MRE.

Mr. Lekstrom said the results “continue to demonstrate the impressive step-out success and the broader scale of mineralization beyond the boundaries of the current resource.”

On November 27, 2024, NEXM released the MRE for Selkirk Mine, which includes an Inferred resource of 44.2 million tonnes at 0.81% copper equivalent.

And on July 9, NEXM announced it had completed an additional 2,819 meters of drilling outside the Selkirk MRE across ten holes after having added a second drill rig to complete a 12‑hole program.

It now plans to expand the exploration efforts to include a targeted electromagnetic program.

Mr. Lekstrom explained that results to date at Selkirk are “clearly demonstrating it has significant resource growth potential,” including “additional high-grade mineralization.”

On July 17, NEXM announced it had received big news: a non-binding letter of interest from the Export-Import Bank of the U.S.

The letter “indicates the potential for up to US $150 million in financing, with a maximum 15-year repayment tenor, to support the re-development of NEXM's Selebi and Selkirk nickel-copper-cobalt-platinum group metal mines in Botswana.”

Mr. Lekstrom commented, “This represents a willingness from the United States to fund critical metals projects in one of Africa's safest and most stable jurisdictions.”

He added, “We anticipate our aggressive growth trajectory to align with our shared objective of delivering new, sustainable sources of critical metals for the U.S. and its allies contributing to the future of the global critical metals supply chain."

That would be on top of the C$46 million in cash and equivalents the company reported as of March 31.

Be sure to do your own research on NEXM, starting with this investor webinar from last month, this investor presentation from this month, and the company website.

As always, be sure to approach your trading in a responsible manner. Trading is very risky, and nothing is ever guaranteed, so never trade with more than you can afford to lose.

Please read the full disclaimer at the bottom of this email as well so you are aware of additional risks and considerations. Always have a well-thought-out game plan that takes your personal risk tolerance into consideration.

Bottom line: NEXM is up 28% from its low on Tuesday, and has ramped up with only nominal pullbacks.

Watch it like a hawk today to see if the breakout continues!

To Your Success,

Questions or concerns about our products? Email [email protected] © Copyright 2022, RagingBull

*DISCLAIMER: This entity is owned by Sherwood Ventures LLC (SV). To more fully understand any SV subscription, website, application or other service, please review our full disclaimer located at https://bullseyealerts.com/disclaimer/

Just so you know, what you're reading is curated content for which we have received a monetary fee (detailed below) to create and distribute. Let's be clear that investing can be quite the roller coaster as stock prices can have wild swings up and down, so consider those crucial risks before you ever consider trading anything we discuss. Make sure you check out our full disclosure down below for the details on how we were paid, the risks, and why these results aren't what you'd call “typical.”

Just a quick heads up about this ad you're reading—as we’ve said, even though we like the company referenced above, and all the facts we discussed above are true to the best of our knowledge, we are running a business here. To distribute this information and help offset the costs of maintaining our large digital audience, in advance of writing the content above, we received twenty five thousand dollars (cash) from Sica Media for advertising NexMetals Mining for a one day marketing program starting on July 24, 2025. It might seem obvious, but while our client claims not to own any shares in NexMetals Mining, whoever ultimately paid them most likely owns shares. You should assume they are looking to sell some or all of them at any time after we send out this information, which might negatively affect the stock price. We may also buy or sell shares in the company at some point in the future, although neither Sherwood Ventures nor its owners own any shares of the company at this time. Also, keep in mind that due to the sheer size of our audience, if even a small percentage of people decide they want to buy this stock, it could potentially boost interest enough to hike up those share prices and cause a temporary spike, and the opposite is possible as the marketing campaign ends, though that is not always the case.

Now, diving right into NexMetals Mining might sound exciting. But remember, it’s like venturing into the wilderness—be aware that there's exceptional risk involved in trading. This isn't small potatoes we're talking about; you could lose every dime you put in, so always carefully think about what you’re doing. That’s why they call this trading, after all. We're shining a light on the good stuff about the company here, but it's on you to do your homework, make your own calls, and determine a plan for your own trading, hopefully with the help of your professional 1nvestment advis0r.

Oh, that brings us to another crucial point—we're not here to tell you (or even recommend) what you should do with your hard-earned money. We’re simply sharing our non-expert thoughts by highlighting some companies who are paying us and we like that could use some help telling their story to more people. We’re obviously biased in our writing. We’re not here to dig into anything that may be negative about the company; this is advertising, after all! Also, keep in mind that if we make some predictions about the future, these are technically known as “forward-L00king statements” under the securities acts, so take those with a grain of salt. As with all forecasts, they’re not set in stone, often wrong, and we certainly can’t know where the Company’s earnings, business, or share price will be tomorrow or a year from now.

Everything you read from us is all for your education, information, and possible entertainment. While we believe the info is reliable and accurate, we can't wear a cape and guarantee it. Before you jump into anything, make sure to talk it over with a pro—someone you trust who's licensed to give you real advice. To be clear,

Neither Sherwood Ventures nor its owners, employees, or independent contractors are registered as a securities broker-dealer, broker, 1nvest.ment advis0r (IA), or IA rep’s with the SEC, any state securities regulatory authority, or any self-regu1atory organization.

So, that's the scoop! If you're intrigued and want to learn more about the companies we talk about, hit up the SEC's website to dig into their filings and see the full picture.