- Bullseye Trades

- Posts

- Goldman's Grid Got a Nuclear Transfusion

Goldman's Grid Got a Nuclear Transfusion

The plumbing under Wall Street just changed forever

*Disseminated for Uranium Royalty Corp.

New York didn't debate. It ordered.

On June 23, 2025, Governor Kathy Hochul directed the state's public utility to build an advanced nuclear plant — New York's first in 37 years.

The state that hosts 40% of global finance just declared nuclear essential infrastructure.

Not for climate goals. For grid reliability.

The 9:30 AM Reality Check

Here's the grid's dirty secret: Renewables can't run trading floors.

When the NYSE opening bell rings on a windless December morning, wind farms are expensive lawn ornaments.

When Goldman Sach's servers process a hundred billion-dollar trade, there's no room for "intermittent" in the power supply.

New York didn't just order a nuclear plant for upstate. It ordered insurance for Manhattan's grid.

Because when California's grid failed, Silicon Valley went dark. New York won't let that happen to Wall Street.

The quiet part said loud: Only nuclear delivers carbon-free baseload at scale.

And tomorrow, that nuclear baseload will keep Manhattan's markets running whether Wall Street realizes it or not.

The Supply Shock

Every nuclear reactor needs fuel.

Palisades (in Michigan) alone will again devour 400,000 pounds annually when put back into operation. New York's advanced reactor? Even more on the initial load.

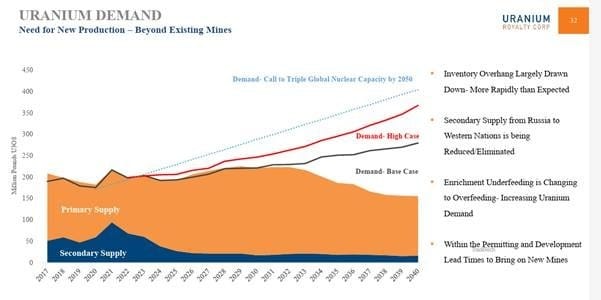

· Current mine production: 75% of demand.

· Current stockpiles: crumbs.

· Current timeline: Accelerating monthly as demand is on track to double by 2024

Source: UxC Market Outlook Q3 2025 and Uranium Royalty Corp deck

For 30 years, America lived off a bizarre Cold War dividend that enabled America to power cities with decommissioned Soviet warheads.

Half of America’s nuclear fuel came from Russian bombs.

That party ended, and we've been draining strategic reserves ever since.

Now New York needs new nuclear. Michigan is restarting the old plants. And the cupboard is bare.

Enter the company that saw this coming years ago.

Uranium Royalty Corp (NASDAQ: UROY)

They did something brilliantly simple: They applied the proven royalty model from gold mining to uranium's supply crunch.

They don't dig holes. They don't fight environmentalists. They don't spend billions on mine infrastructure and equipment.

Why This Model Wins Now

Uranium mining is brutal, and it can take a minimum of 10 years to bring a new mine online (if all goes well).

Plus, there are environmental permits. Local opposition. Technical challenges.

These are capital requirements that can break companies.

Uranium Royalty Corp (NASDAQ:UROY)

They can be an ideal financing partner for uranium companies.

Banks avoided uranium. Private equity wants control. Traditional investors demand instant returns.

UROY offers something different…

UROY’s Fortified Balance Sheet: With USD$220M (~CAD$305 million) in liquid assets as of September 2025, UROY is primed to pursue value-accretive royalty and streaming deals, turning market volatility into opportunity.

When a developer needs $50 million, they can either dilute shareholders into oblivion or sell UROY a royalty.

There’s no dilution. No loss of control. Just a permanent partner who wins when they win.

Here's what makes this model genius: Diversification without Dilution.

Mining is a tough business.

Miners always face technical problems, permitting delays, capex over runs and many other problems that can cripple a stock share price.

And unlike miners who see costs rise with uranium prices…

Royalties are pure upside.

New York's Nuclear Order

And the end of Russian supply creates a perfect storm that utilities haven't seen coming.

They've been sleepwalking through decades of cheap uranium from dismantled warheads. Now they're waking up to empty shelves and a producer community that barely survived the lean years.

The miners who made it through are picking their partners carefully.

Uranium Royalty Corp bought all existing royalties in the secondary market.

And CEO Scott Melbye states that “most of our new business opportunities are potential new royalties as a capital provider.”

Manhattan's Nuclear Future

New York's advanced reactor will power the infrastructure of global finance.

Palisades will hum again in Michigan. A dozen states will follow.

Because when the Empire State admits it needs nuclear, everyone does the math.

The uranium to fuel this renaissance must come from somewhere.

The projects to produce it need funding. Every pound that moves from ground to reactor passes through the same bottleneck.

👉And there is no way the big companies who need the uranium will rely on unstable production sources such as Kazakhstan and Russia.

UROY already owns 2.4 million pounds of uranium.

And has 25 interests in 22 uranium projects at various stages including large producers such as McArthur River and Cigar Lake.

Source: UROY Oct 2025 Investor Presentation

Uranium Royalty Corp built the mousetrap to capture that flow.

Not by taking massive risks or fighting endless battles, but by positioning itself as the partner the industry desperately needs.

When Wall Street's grid chose nuclear, it chose uranium.

And when you choose uranium, there's a compelling case for choosing the company that wins regardless of which projects succeed.

Because in the end, they all need fuel.

You should review UROY's most recent Annual Information Form and other filings under its profile at sedarplus.ca and www.sec.gov for important information on its business and assets.

Regards,

Marin Katusa

IMPORTANT DISCLAIMER & DISCLOSURES

Investing in stocks is HIGH RISK. You could lose All of your investment.

Katusa Research, as a publisher, is not a broker, investment advisor, or financial advisor in any jurisdiction.

Please do not rely on the information presented by Katusa Research as personal investment advice.

If you need personal investment advice, kindly reach out to a qualified and registered broker, investment advisor, or financial advisor.

The communications from Katusa Research should not form the basis of your investment decisions. Examples we provide regarding share price increases related to specific companies are based on randomly selected time periods and should not be taken as an indicator or predictor of future stock prices for those companies.

Uranium Royalty Corp is a paid sponsor of this report.

The information in this newsletter does not constitute an offer to sell or a solicitation of an offer to buy any securities of a corporation or entity, including U.S. Traded Securities or U.S. Quoted Securities, in the United States or to U.S. Persons. Securities may not be offered or sold in the United States except in compliance with the registration requirements of the Securities Act and applicable U.S. state securities laws or pursuant to an exemption therefrom.

Any public offering of securities in the United States may only be made by means of a prospectus containing detailed information about the corporation or entity and its management as well as financial statements. No securities regulatory authority in the United States has either approved or disapproved of the contents of any newsletter. Katusa Research nor any employee of Katusa Research is not registered with the United States Securities and Exchange Commission (the “SEC”): as a “broker-dealer” under the Exchange Act, as an “investment adviser” under the Investment Advisers Act of 1940, or in any other capacity. Katusa Research, its owners, directors, and employees are also not registered with any state securities commission or authority as a broker-dealer or investment advisor or in any other capacity.

HIGHLY BIASED:

In our role, we aim to highlight specific companies for your further investigation; however, these are not stock recommendations, nor do they constitute an offer or sale of the referenced securities. Katusa Research partner company, New Era Publishing Inc. has received cash compensation in the amount of $1.25M from Uranium Royalty Corp and is thus extremely biased. It is crucial that you conduct your own research prior to investing. This includes reading the company's SEDAR and SEC filings, press releases, and risk disclosures. The information contained herein regarding Uranium Royalty Corp. has been derived from its SEDAR+ and SEC filings, including scientific and technical information regarding its royalty assets which has been reviewed and approved by Darcy Hirsekorn, its Chief Technical Officer and is a professional geoscientist in Saskatchewan and a qualified person as defined in National Instrument 43-101 Standards of Disclosure for Mineral Projects and is registered as a professional geoscientist in Saskatchewan. Information regarding the projects underlying Uranium Royalty Corp.’s interests has been derived from the publicly available disclosure of the underlying operators and owners, including where referenced herein.

Katusa Research, and its directors, employees, and members of their households directly own or may own shares of Uranium Royalty Corp (UROY/UROY.TSX). Therefore, Katusa Research is extremely biased. Measures are in place such that no shares will be sold during the active awareness campaign.

HIGH RISK:

The securities issued by the companies we feature should be seen as high risk; if you choose to invest, despite these warnings, you may lose your entire investment. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures.

NOT PROFESSIONAL ADVICE:

By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim. While Katusa Research strives to provide accurate and reliable information sourced from believed-to-be trustworthy sources, we cannot guarantee the accuracy or reliability of the information. The information provided reflects conditions as they are at the moment of writing and not at any future date. Katusa Research is not obligated to update, correct, or revise the information post-publication.

FORWARD-LOOKING STATEMENTS:

Certain information presented may contain or be considered forward-looking statements. Such statements involve known and unknown risks, uncertainties, and other factors that may cause actual results or events to differ materially from those anticipated in these statements. There can be no assurance that any such statements will prove to be accurate, and readers should not place undue reliance on such information. These statements are subject to known and unknown risks including those set forth in Uranium Royalty Corp.’s most recent annual information form and other public filings available at www.sedarplus.ca and www. sec. gov. Neither Katusa Research nor Uranium Royalty Corp. undertake any obligations to update the information presented or to ensure that such information remains current and accurate, except as required under applicable law.

*DISCLAIMER: This entity is owned by Sherwood Ventures LLC (SV). To more fully understand any SV subscription, website, application or other service, please review our full disclaimer located at https://bullseyealerts.com/disclaimer/

Just so you know, what you're reading is curated content for which we have received a monetary fee (detailed below) to create and distribute. Let's be clear that investing can be quite the roller coaster as stock prices can have wild swings up and down, so consider those crucial risks before you ever consider trading anything we discuss. Make sure you check out our full disclosure down below for the details on how we were paid, the risks, and why these results aren't what you'd call “typical.”

Just a quick heads up about this ad you're reading—as we’ve said, even though we like the company referenced above, and all the facts we discussed above are true to the best of our knowledge, we are running a business here. To distribute this information and help offset the costs of maintaining our large digital audience, in advance of writing the content above, we received forty thousand dollars (cash) from New Era Publishing for advertising Uranium Royalty Corp for a three day marketing program starting on October 26, 2025. Previously, we received fifty thousand dollars (cash) from New Era Publishing for advertising Uranium Royalty Corp for a one day marketing program starting on August 18, 2025. To date, we have received a total of ninety thousand dollars for advertising Uranium Royalty Corp.

It might seem obvious, but while our client claims not to own any shares in Uranium Royalty Corp, whoever ultimately paid them most likely owns shares. You should assume they are looking to sell some or all of them at any time after we send out this information, which might negatively affect the stock price. We may also buy or sell shares in the company at some point in the future, although neither Sherwood Ventures nor its owners own any shares of the company at this time. Also, keep in mind that due to the sheer size of our audience, if even a small percentage of people decide they want to buy this stock, it could potentially boost interest enough to hike up those share prices and cause a temporary spike, and the opposite is possible as the marketing campaign ends, though that is not always the case.

Now, diving right into Uranium Royalty Corp might sound exciting. But remember, it’s like venturing into the wilderness—be aware that there's exceptional risk involved in trading. This isn't small potatoes we're talking about; you could lose every dime you put in, so always carefully think about what you’re doing. That’s why they call this trading, after all. We're shining a light on the good stuff about the company here, but it's on you to do your homework, make your own calls, and determine a plan for your own trading, hopefully with the help of your professional 1nvestment advis0r.

Oh, that brings us to another crucial point—we're not here to tell you (or even recommend) what you should do with your hard-earned money. We’re simply sharing our non-expert thoughts by highlighting some companies who are paying us and we like that could use some help telling their story to more people. We’re obviously biased in our writing. We’re not here to dig into anything that may be negative about the company; this is advertising, after all! Also, keep in mind that if we make some predictions about the future, these are technically known as “forward-L00king statements” under the securities acts, so take those with a grain of salt. As with all forecasts, they’re not set in stone, often wrong, and we certainly can’t know where the Company’s earnings, business, or share price will be tomorrow or a year from now.

Everything you read from us is all for your education, information, and possible entertainment. While we believe the info is reliable and accurate, we can't wear a cape and guarantee it. Before you jump into anything, make sure to talk it over with a pro—someone you trust who's licensed to give you real advice. To be clear,

Neither Sherwood Ventures nor its owners, employees, or independent contractors are registered as a securities broker-dealer, broker, 1nvest.ment advis0r (IA), or IA rep’s with the SEC, any state securities regulatory authority, or any self-regu1atory organization.

So, that's the scoop! If you're intrigued and want to learn more about the companies we talk about, hit up the SEC's website to dig into their filings and see the full picture.