- Bullseye Trades

- Posts

- Here’s Why They're Putting $50,000 GPUs in Tents

Here’s Why They're Putting $50,000 GPUs in Tents

Big things are happening...

*Disseminated for Uranium Royalty Corp.

In late August, Mark Zuckerberg posted a video that could have crashed the market.

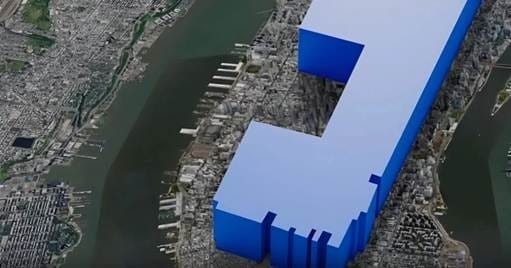

He showed Manhattan being slowly consumed by a blue digital blob. Not Godzilla. Not aliens. It’s a data center footprint.

His company's next facility — codenamed Hyperion — is so large that it would cover 80% of Manhattan if you dropped it on top.

Wall Street yawned.

The media ran their thousandth "AI revolution" story.

Meanwhile, in rural Louisiana, something unprecedented is happening that will determine who gets rich and who gets left behind over the next decade.

Meta and OpenAI’s Nuclear Tell

Here's what Zuckerberg didn't mention in his Hyperion video:

Practically every tech CEO knows their AI dreams are physically impossible with today's power grid. They're signing contracts for electricity that DOESN'T EXIST YET.

Think about that.

OpenAI needs 10 gigawatts for Stargate alone. That’s the equivalent of about 10 nuclear reactors.

It's like ordering a fleet of rockets before inventing fuel.

This impossible math has created a big energy problem.

And there's currently only one solution that runs 24/7, requires minimal land, and could potentially scale fast enough: nuclear.

That's why Meta just locked in a 20-year nuclear deal with Constellation Energy.

It’s not a pilot program or a research partnership. It’s a two-decade commitment to split atoms for Instagram reels.

The Violent Math Nobody Sees…

In 2025, the world needs 193 million pounds of uranium. The world produces 165 million. That's a 28 million-pound hole.

Before a single new data center powers up.

Now add Meta's proposed Manhattan-sized monster. Amazon's nuclear purchases. Microsoft's reactor plans. Google's atomic ambitions.

The supply deficit doesn't grow gradually.

Meta's nuclear deal with Constellation Energy includes something nobody's talking about:

They're literally bringing a dead reactor back to life.

Plants that were shuttered, written off, forgotten.

Suddenly valuable because a social media company needs to train language models.

The nuclear graveyard of America — dozens of "permanently" closed facilities — just became the most valuable real estate.

And every zombie reactor waking up needs one thing: uranium. Fresh fuel. Millions of pounds of it.

When supply can't meet demand, prices should rise.

Ask anyone who bought uranium at $17 in 2016 and watched it climb past $70 in 2024 — heading toward the $138 peak last seen in 2007.

Things can always change just as quickly and there are many factors that can impact uranium prices and demand.

INVESTMENT PLAY: Follow The Toll Collectors

Every data center needs power. And when the world's richest companies start writing checks with more zeros than most nations' GDPs, they can create an upstream effect.

Uranium Royalty Corp (NASDAQ:UROY) are not miners.

They don't dig holes or manage crews.

They have "toll booths" to collect royalties.

When uranium moves from the ground on a project they hold a royalty on to the reactor — they can get paid.

Physical uranium bought when everyone thought nuclear was dead.

Uranium Royalty Corp (NASDAQ:UROY) holds royalties on the McArthur River and Cigar Lake uranium mines in Saskatchewan, Canada, which are among the world's largest and highest-grade mines.

The company acquired these interests in 2021, during a period when nuclear energy was perceived as less favorable, positioning it to benefit from a resurgence in nuclear fuel demand.

Royalties on McArthur River and Cigar Lake — where a lot of America's nuclear fuel currently originates.

Note: Uranium Royalty Corp.'s NPI (net profit interest) model is a type of royalty that provides the company with a percentage of a project's net profits, but only after all initial costs have been paid off. This is different from a gross revenue model, where payments start immediately and are based on sales, not profit.

This is the same model that has successfully been implanted by others in gold and silver.

The Tent Stakes Are Already in the Ground

The servers are in tents. The nuclear deals are signed.

The zombie reactors are stirring. The 28 million pound gap is real today — and potentially widening tomorrow if current trends continue.

UROY on NASDAQ. URC on TSX.

The first and only pure-play uranium royalty company on Earth…

Uranium Royalty Corp (NASDAQ:UROY) already owns 2.4 million pounds of uranium.

👉And has 25 interests in 22 uranium projects at various stages including large producers such a McArthur River and Cigar Lake.

You should review UROY's most recent Annual Information Form and other filings under its profile at www.sedarplus.ca and www.sec.gov for important information on UROY's business, royalties and other assets.

Regards,

Marin Katusa and the KR Special Situations Team

IMPORTANT DISCLAIMER & DISCLOSURES

Investing in stocks is HIGH RISK. You could lose All of your investment.

Katusa Research, as a publisher, is not a broker, investment advisor, or financial advisor in any jurisdiction.

Please do not rely on the information presented by Katusa Research as personal investment advice.

If you need personal investment advice, kindly reach out to a qualified and registered broker, investment advisor, or financial advisor.

The communications from Katusa Research should not form the basis of your investment decisions. Examples we provide regarding share price increases related to specific companies are based on randomly selected time periods and should not be taken as an indicator or predictor of future stock prices for those companies.

Uranium Royalty Corp is a paid sponsor of this report.

The information in this newsletter does not constitute an offer to sell or a solicitation of an offer to buy any securities of a corporation or entity, including U.S. Traded Securities or U.S. Quoted Securities, in the United States or to U.S. Persons. Securities may not be offered or sold in the United States except in compliance with the registration requirements of the Securities Act and applicable U.S. state securities laws or pursuant to an exemption therefrom.

Any public offering of securities in the United States may only be made by means of a prospectus containing detailed information about the corporation or entity and its management as well as financial statements. No securities regulatory authority in the United States has either approved or disapproved of the contents of any newsletter. Katusa Research nor any employee of Katusa Research is not registered with the United States Securities and Exchange Commission (the “SEC”): as a “broker-dealer” under the Exchange Act, as an “investment adviser” under the Investment Advisers Act of 1940, or in any other capacity. Katusa Research, its owners, directors, and employees are also not registered with any state securities commission or authority as a broker-dealer or investment advisor or in any other capacity.

HIGHLY BIASED:

In our role, we aim to highlight specific companies for your further investigation; however, these are not stock recommendations, nor do they constitute an offer or sale of the referenced securities. Katusa Research partner company, New Era Publishing Inc. has received cash compensation in the amount of $1.25M from Uranium Royalty Corp and is thus extremely biased. It is crucial that you conduct your own research prior to investing. This includes reading the company's SEDAR and SEC filings, press releases, and risk disclosures. The information contained herein regarding Uranium Royalty Corp. has been derived from its SEDAR+ and SEC filings, including scientific and technical information regarding its royalty assets which has been reviewed and approved by Darcy Hirsekorn, its Chief Technical Officer and is a professional geoscientist in Saskatchewan and a qualified person as defined in National Instrument 43-101 Standards of Disclosure for Mineral Projects and is registered as a professional geoscientist in Saskatchewan. Information regarding the projects underlying Uranium Royalty Corp.’s interests has been derived from the publicly available disclosure of the underlying operators and owners, including where referenced herein.

Katusa Research, and its directors, employees, and members of their households directly own or may own shares of Uranium Royalty Corp (UROY/UROY.TSX). Therefore, Katusa Research is extremely biased. Measures are in place such that no shares will be sold during the active awareness campaign.

HIGH RISK:

The securities issued by the companies we feature should be seen as high risk; if you choose to invest, despite these warnings, you may lose your entire investment. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures.

NOT PROFESSIONAL ADVICE:

By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim. While Katusa Research strives to provide accurate and reliable information sourced from believed-to-be trustworthy sources, we cannot guarantee the accuracy or reliability of the information. The information provided reflects conditions as they are at the moment of writing and not at any future date. Katusa Research is not obligated to update, correct, or revise the information post-publication.

FORWARD-LOOKING STATEMENTS:

Certain information presented may contain or be considered forward-looking statements. Such statements involve known and unknown risks, uncertainties, and other factors that may cause actual results or events to differ materially from those anticipated in these statements. There can be no assurance that any such statements will prove to be accurate, and readers should not place undue reliance on such information. These statements are subject to known and unknown risks including those set forth in Uranium Royalty Corp.’s most recent annual information form and other public filings available at www.sedarplus.ca and www. sec. gov. Neither Katusa Research nor Uranium Royalty Corp. undertake any obligations to update the information presented or to ensure that such information remains current and accurate, except as required under applicable law.

*DISCLAIMER: This entity is owned by Sherwood Ventures LLC (SV). To more fully understand any SV subscription, website, application or other service, please review our full disclaimer located at https://bullseyealerts.com/disclaimer/

Just so you know, what you're reading is curated content for which we have received a monetary fee (detailed below) to create and distribute. Let's be clear that investing can be quite the roller coaster as stock prices can have wild swings up and down, so consider those crucial risks before you ever consider trading anything we discuss. Make sure you check out our full disclosure down below for the details on how we were paid, the risks, and why these results aren't what you'd call “typical.”

Just a quick heads up about this ad you're reading—as we’ve said, even though we like the company referenced above, and all the facts we discussed above are true to the best of our knowledge, we are running a business here. To distribute this information and help offset the costs of maintaining our large digital audience, in advance of writing the content above, we received forty thousand dollars (cash) from New Era Publishing for advertising Uranium Royalty Corp for a three day marketing program starting on October 26, 2025. Previously, we received fifty thousand dollars (cash) from New Era Publishing for advertising Uranium Royalty Corp for a one day marketing program starting on August 18, 2025. To date, we have received a total of ninety thousand dollars for advertising Uranium Royalty Corp.

It might seem obvious, but while our client claims not to own any shares in Uranium Royalty Corp, whoever ultimately paid them most likely owns shares. You should assume they are looking to sell some or all of them at any time after we send out this information, which might negatively affect the stock price. We may also buy or sell shares in the company at some point in the future, although neither Sherwood Ventures nor its owners own any shares of the company at this time. Also, keep in mind that due to the sheer size of our audience, if even a small percentage of people decide they want to buy this stock, it could potentially boost interest enough to hike up those share prices and cause a temporary spike, and the opposite is possible as the marketing campaign ends, though that is not always the case.

Now, diving right into Uranium Royalty Corp might sound exciting. But remember, it’s like venturing into the wilderness—be aware that there's exceptional risk involved in trading. This isn't small potatoes we're talking about; you could lose every dime you put in, so always carefully think about what you’re doing. That’s why they call this trading, after all. We're shining a light on the good stuff about the company here, but it's on you to do your homework, make your own calls, and determine a plan for your own trading, hopefully with the help of your professional 1nvestment advis0r.

Oh, that brings us to another crucial point—we're not here to tell you (or even recommend) what you should do with your hard-earned money. We’re simply sharing our non-expert thoughts by highlighting some companies who are paying us and we like that could use some help telling their story to more people. We’re obviously biased in our writing. We’re not here to dig into anything that may be negative about the company; this is advertising, after all! Also, keep in mind that if we make some predictions about the future, these are technically known as “forward-L00king statements” under the securities acts, so take those with a grain of salt. As with all forecasts, they’re not set in stone, often wrong, and we certainly can’t know where the Company’s earnings, business, or share price will be tomorrow or a year from now.

Everything you read from us is all for your education, information, and possible entertainment. While we believe the info is reliable and accurate, we can't wear a cape and guarantee it. Before you jump into anything, make sure to talk it over with a pro—someone you trust who's licensed to give you real advice. To be clear,

Neither Sherwood Ventures nor its owners, employees, or independent contractors are registered as a securities broker-dealer, broker, 1nvest.ment advis0r (IA), or IA rep’s with the SEC, any state securities regulatory authority, or any self-regu1atory organization.

So, that's the scoop! If you're intrigued and want to learn more about the companies we talk about, hit up the SEC's website to dig into their filings and see the full picture.