- Bullseye Trades

- Posts

- Is this the calm before the storm 👀

Is this the calm before the storm 👀

It’s not moving fast... yet.

Issuer-Sponsored Content from VolitionRX, Ltd*

Markets are a little shaky after big tech earnings, but that’s when interesting setups start to show up. I’m keeping an eye on one small stock that’s holding its ground after months of selling. It’s now at a level I’m watching closely today.

TODAY’S TOP ALERT!

VolitionRX (NYSE: VNRX)

👉 VNRX is TODAY’S #1 ALERT* 👈

Hey Folks, Jeff Bishop here,

The markets took a hit yesterday after Microsoft's earnings sent its stock tumbling 10%...

Apple saved the day after the bell, though, when it reported revenues up 16% on an annual basis.

Then, Tesla surprised the markets in after hours by announcing a potential merger with SpaceX.

Things are looking spicy once again!

I’m watching for a market rebound today, and one small stock in particular has caught my attention.

💥Take a look at tiny VolitionRx Limited (VNRX)* on your trading platform.

After a long downtrend since October, the stock has now spent several weeks stabilizing in the $0.23–$0.27 range.

That’s important, because stocks rarely bottom in one day. They typically form a base where selling pressure fades and buyers start stepping in, and you can see that clearly with this stock…

Both dips toward the $0.23–$0.24 level were bought — including one nearly 80% runup — and the stock didn’t break meaningfully lower.

The question now, as the stock returns to that support, is whether the buyers step in again?

That’s what I’m watching for today.

👉 VNRX is TODAY’S #1 ALERT* 👈

The company itself was founded in 2010 “with the aim of transforming diagnostics from expensive, invasive, and often unpleasant procedures to something as fast and accessible as cholesterol or pregnancy testing.”

It’s building blood-based tests that look for disease signals by measuring nucleosomes — DNA-protein packages that spill into the bloodstream when there’s unusually high cell turnover, as in cancer or serious inflammation.

VNRX markets its platform as Nu.Q® (“nucleosome quantification”) Technology.

The upshot is that instead of finding a tumor directly via an invasive biopsy or expensive imaging, VNRX’s tests try to detect patterns associated with a disease in a routine blood draw.

It currently holds 71 granted patents, with coverage up to 2044

The company says its Nu.Q® Vet Cancer Test is “the number one canine cancer screening blood test in the world, available in over 20 countries.” [emphasis added]

And its other tests are increasingly being screened for human oncology and sepsis.

In 2025, the company increasingly pushed toward commercialization…

In March, it announced the expansion of a Nu.Q® Vet Cancer Test supply agreement with Fujifilm Vet Systems in Japan, aimed at running the test on an automated analyzer platform.

Then in August, it reported $0.4 million in Q2 revenue, which brought first half 2025 growth to 15% over the prior year.

In November, it revealed Q3 revenue of $0.6 million, representing growth of 32% over the year-prior quarter.

But in Q4, VNRX began rolling out the kind of news investors want to see from diagnostics companies: early clinical commercialization steps.

November 25: Announced the first sale of its Nu.Q® Cancer assays to one of Europe's leading cancer centers, Hospices Civils de Lyon in France. The sale was framed as “a major milestone for Volition in the commercialization and licensing of Nu.Q® in the human cancer field” and a step “on the path to the first use of Nu.Q® in clinical practice.”

December 4: Said its Nu.Q® NETs Assay was included as an “innovative biomarker” in France’s real-world evaluation program for early sepsis detection. That’s critical because sepsis is a clinical need where faster diagnosis can make a big difference.

December 11: Released a pre-print manuscript that “showcases both a new method, Capture-Seq™, and new biomarkers for the detection of cancer, holding the promise of accurate, low-cost tests for a wide range of cancers.” It thinks it may have solved the “needle in the haystack” problem for liquid biopsies.

VNRX issued a “Business Review 2025” update on December 17 that’s well worth reading for a full sense of what the company is up to.

The thing that jumped out most to me was that the company is in licensing discussions “with around 10 of the world's leading diagnostic and liquid biopsy companies. These discussions are at various stages of the negotiation process across all our different pillars, and we anticipate announcing additional agreements throughout 2026.” [emphasis added]

On January 8, VNRX announced breakthrough Nu.Q® Vet clinical data in detecting lymphoma in cats. That’s the most common cancer in the species, and the company’s assay detected over 80% of feline lymphomas with no false positives.

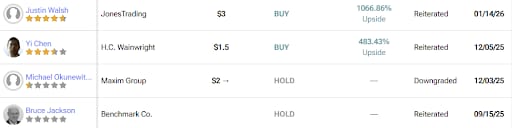

Wrapping up, I should note that the stock has received some impressive 12-month valuations from analysts:

As you do your own research, this corporate presentation released this month is worth reviewing, as is the company website.

As always, be sure to approach your trading in a responsible manner. Trading is very risky, and nothing is ever guaranteed, so never trade with more than you can afford to lose.

Please read the full disclaimer at the bottom of this email as well so you are aware of our compensation and other conflicts of interest, as well as additional risks and considerations. Always have a well-thought-out game plan that takes your personal risk tolerance into consideration.

To Your Success,

P.S. Make sure you join me and over 1000 traders in the Market Master’s trading room today for live trading signals and education. You can access it at no cost right now.

*ISSUER-SPONSORED DISCLAIMER: This entity is owned by Sherwood Ventures LLC (SV). To more fully understand any SV subscription, website, application or other service, please review our full disclaimer located at https://bullseyealerts.com/disclaimer/

Just so you know, what you're reading is curated content for which we have received a monetary fee (detailed below) to create and distribute. Let's be clear that investing can be quite the roller coaster as stock prices can have wild swings up and down, so consider those crucial risks before you ever consider trading anything we discuss. Make sure you check out our full disclosure down below for the details on how we were paid, the risks, and why these results aren't what you'd call “typical.”

Just a quick heads up about this ad you're reading—as we’ve said, even though we like the company referenced above, and all the facts we discussed above are true to the best of our knowledge, we are running a business here. To distribute this information and help offset the costs of maintaining our large digital audience, in advance of writing the content above, we received thirty five thousand thousand dollars (cash) from VolitionRX Limited (via Lifewater Media) for a one day marketing program starting on January 30, 2026.

It might seem obvious, but while our client claims not to own any shares in VolitionRX Limited, whoever ultimately paid them most likely owns shares. You should assume they are looking to sell some or all of them at any time after we send out this information, which might negatively affect the stock price. We may also buy or sell shares in the company at some point in the future, although neither Sherwood Ventures nor its owners own any shares of the company at this time. Also, keep in mind that due to the sheer size of our audience, if even a small percentage of people decide they want to buy this stock, it could potentially boost interest enough to hike up those share prices and cause a temporary spike, and the opposite is possible as the marketing campaign ends, though that is not always the case.

Now, diving right into VolitionRX Limited might sound exciting. But remember, it’s like venturing into the wilderness—be aware that there's exceptional risk involved in trading. This isn't small potatoes we're talking about; you could lose every dime you put in, so always carefully think about what you’re doing. That’s why they call this trading, after all. We're shining a light on the good stuff about the company here, but it's on you to do your homework, make your own calls, and determine a plan for your own trading, hopefully with the help of your professional 1nvestment advis0r.

Oh, that brings us to another crucial point—we're not here to tell you (or even recommend) what you should do with your hard-earned money. We’re simply sharing our non-expert thoughts by highlighting some companies who are paying us and we like that could use some help telling their story to more people. We’re obviously biased in our writing. We’re not here to dig into anything that may be negative about the company; this is advertising, after all! Also, keep in mind that if we make some predictions about the future, these are technically known as “forward-L00king statements” under the securities acts, so take those with a grain of salt. As with all forecasts, they’re not set in stone, often wrong, and we certainly can’t know where the Company’s earnings, business, or share price will be tomorrow or a year from now.

Everything you read from us is all for your education, information, and possible entertainment. While we believe the info is reliable and accurate, we can't wear a cape and guarantee it. Before you jump into anything, make sure to talk it over with a pro—someone you trust who's licensed to give you real advice. To be clear, neither Sherwood Ventures nor its owners, employees, or independent contractors are registered as a securities broker-dealer, broker, 1nvest.ment advis0r (IA), or IA rep’s with the SEC, any state securities regulatory authority, or any self-regu1atory organization.

So, that's the scoop! If you're intrigued and want to learn more about the companies we talk about, hit up the SEC's website to dig into their filings and see the full picture.