- Bullseye Trades

- Posts

- Missed SLDP, QS, AMPX 😩 - Don’t Miss THIS!

Missed SLDP, QS, AMPX 😩 - Don’t Miss THIS!

Setting up as the next big battery IPO

*together with Paladin Power

Happy weekend, Folks! Jeff Bishop here with something to keep on your investing radar.

The red-HOT energy storage sector 🔥.

This sector is exploding right now, with publicly-traded battery stocks making big moves, which I’’ll show you in a second.

Meanwhile, Paladin Power is quietly emerging as one of the most exciting companies that is still private in the space.

Listen, the world is realizing something simple: AI, EVs, and energy storage all depend on one thing — better batteries.

The surge in A.I. and cloud computing has triggered an unprecedented wave of new data centers — massive facilities that run 24/7 and consume staggering amounts of electricity.

Each one requires stable, affordable power, yet grids are straining under the load and utility rates are climbing fast.

Astute investors have picked up on this and understand that to power these data centers, we will need exponentially more power, and to save on electricity bills – we need better storage.

Take a quick peek at what just a handful of battery stocks have been doing in recent months.

👉Solid Power Inc. (SLDP) ran from under $1 in April to over $7 in October reaching a market cap of over $1 Billion according to Finviz.

👉Quantumscape Corp (QS) ran from below $3.70 in April to over $18 in October reaching a market cap of over $8.7 Billion (Finviz).

Amprius Technologies Inc (AMPX) ran from less than $1 in late 2024 to over $15 in October reaching a market cap of $1.6 Billion (Finviz).

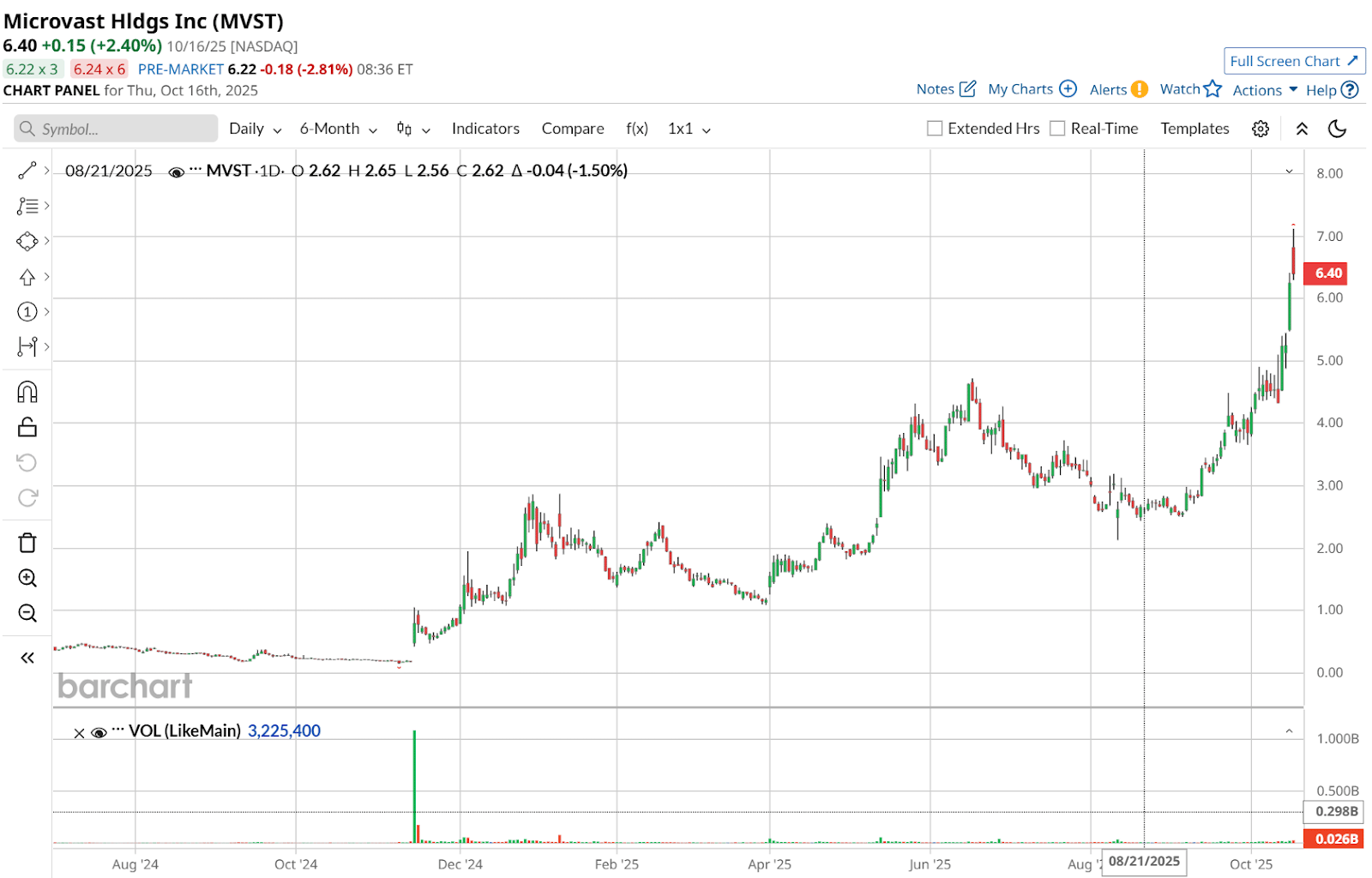

And look at this…Microvast Holdings Inc (MVST) traded at less than 20 cents in November 2024, and ran up to over $6 in October, reaching a market cap of over $2 Billion (Finviz).

Did you notice that none of these market caps are less than one BILLION? And the MASSIVE moves these stocks have made in just a short timeframe?

Folks, the trend here is clear and most investors are kicking themselves for missing the early runs in these names.

These are 10 to 30x moves in market cap and valuation in less than 12 months.

That’s why I’m looking closely at Paladin Power — one of the ONLY private battery companies you can still invest in.

Will this be the next battery company to explode into the same trajectory 🚀?

Investors are pouring billions into anything tied to energy storage — but those are all public.

Paladin Power is still private, and that means you can still get in before Wall Street does.

(Yes, I’m talking about staking your claim before the algos, the big institutions and even Nancy Pelosi, beat you to it! LOL)

Now the best part is, Paladin has already begun talks with investment banks about a potential IPO - as CEO Ted Thomas revealed in my last discussion with him.

If Paladin does go public next year, early investors could be sitting on a front-row seat to one of the biggest battery success stories in recent memory.

🚨 This offering is still open — but not for long.

If you missed the early waves in SLDP, QS, or MVST… this could be your chance to get in before Wall Street catches on.

To YOUR success,

*Disclaimer: This is a paid advertisement for Paladin Power and involves risk, including the possible loss of principal. The valuation is set by the Company. Please read the offering disclosures & related risks that can be found here.

DISCLAIMER: This entity is owned by Sherwood Ventures LLC (SV). Full disclaimer: https://bullseyealerts.com/disclaimer/

*Sponsored content: SV has been paid fifteen dollars by Paladin Power to enhance public awareness of the company for its current marketing program commencing Oct 18th, 2025. SV has been compensated in the past for previous marketing efforts for Paladin but is not currently invested in this company. We recommend that you do your own independent research before investing in anything, as private investing is risky and often illiquid. We believe in the companies we form affiliate relationships with, but please don’t invest any money unless you believe it will help you achieve your goals.

CLIENT CONTENT: SV is not responsible for any content hosted on Client sites; it is the Client's responsibility to ensure compliance with applicable laws.

NOT INVESTMENT ADVICE: Content is for educational, informational, and advertising purposes only and should NOT be construed as securities-related offers or solicitations. All content, regardless of characterization as "educational," should be considered promotional and subject to disclosed conflicts of interest. Do NOT rely on this as personalized investment advice. SV strongly recommends you consult a licensed or registered professional before making any investment decision.

RESULTS NOT TYPICAL: Past performance, testimonials, and historical results are unverified and NOT indicative of future results. Results presented are NOT guaranteed as TYPICAL. Past newsletters, marketing materials, track records, case studies, and promotional content should NOT be relied upon as indication of future performance. Market conditions, regulatory environments, and individual circumstances vary significantly over time. Actual results will vary widely given factors such as experience, skill, risk mitigation practices, market dynamics and capital deployed. Investing in securities is speculative and carries a high degree of risk; you may lose some, all, or possibly more than your original investment.

REGULATORY STATUS: Neither SV nor any of its owners or employees is registered as a securities broker-dealer, broker, investment advisor (IA), or IA representative with the U.S. Securities and Exchange Commission, any state securities regulatory authority, or any self-regulatory organization.

HIGH-RISK SECURITIES: Securities discussed may be penny stocks, small-cap stocks, cryptocurrencies, options, or other highly speculative investments subject to extreme price volatility, rapid and substantial price movements, limited liquidity, regulatory changes, and potential total loss of value. Market conditions can change rapidly and unpredictably.

LEGAL: In any legal action arising from or related to SV services or these terms, SV shall be entitled to recover attorneys' fees, costs, and disbursements in addition to any other relief.