- Bullseye Trades

- Posts

- Momentum’s back on the menu

Momentum’s back on the menu

This one’s up 37% since last Monday

Issuer-Sponsored Content from DevvStream Corp*

The markets have been catching their breath, but one setup has roared back to life. It’s a stock I’ve watched rip several times before, and the momentum is starting to feel familiar again.

TODAY’S TOP ALERT!

DevvStream Corp (Nasdaq: DEVS)

👉 DEVS is TODAY’S #1 ALERT 👈

Hey Folks, Jeff Bishop here,

After taking Thanksgiving week off from “tactical trade” ideas, I came back with a bang yesterday: my idea hit a peak 17% gain and closed up 13% on the day.

Markets climbed modestly yesterday and are green again in the pre-market this morning.

There’s a ton of momentum out there, but one stock has really caught my eye. This is an idea I’ve alerted several times in the past…

Here’s what happened the day I first alerted it, in November 2024:

And here’s how it looked the day I alerted it in March of this year:

In July, we saw this blistering move — the very same day I showed it to you…

Over 120% in just a few hours?!

That was definitely a “hall of fame” type of day, and it was thrilling to watch it.

I alerted it again two weeks later, and we saw yet another double-digit intraday move.

I will never claim that history will repeat (and you should never expect it to), but I am showing you these past alerts to show the potential this one has for short-term moves.

Now let’s get to it!...

💥Fire up your platform and take a look at DevvStream Corp. (DEVS).*

You’ll see some impressive runups over the last six months and certainly over the past year, but beginning in mid-October, the stock slumped…

Until last Monday.

Since November 24, the stock is up 37%, including a 6.7% gain yesterday.

The company is pursuing a crypto treasury strategy in parallel to its normal business, and I think it benefited from the bullishness in crypto over the last 48 hours.

DEVS is up again in the pre-market this morning, so it definitely needs to be on your radar today.

👉 DEVS is TODAY’S #1 ALERT 👈*

DEVS describes itself as “a leading authority in the use of technology in carbon project development.”

The company's mission is “to create alignment between sustainability and profitability, helping organizations achieve their climate initiatives while directly improving their financial health.”

DEVS has its hands in a number of green initiatives with the ultimate goal of reducing the impact of climate change.

Regardless of your views on the politics or science of climate change, we can all agree there is a ton of money flowing to these initiatives…

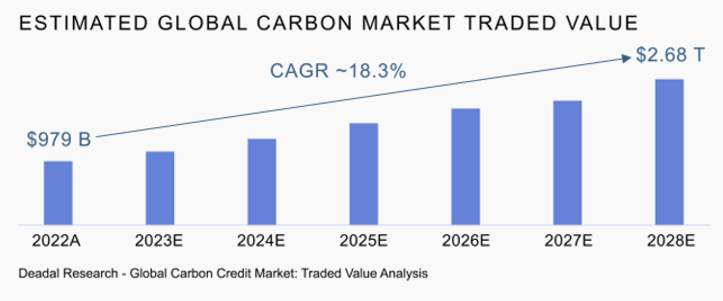

Deadal Research estimates that the global carbon market has already reached $1 trillion and will more than double by 2028:

As an investor and a trader, that’s what most interests me…

DevvStream went public in November 2024 via a de-SPAC merger, in what made it “the first publicly traded carbon credit generation company listed on a major U.S. stock exchange.”

Founded in 2021, the Calgary-based company says it “works with governments and corporations worldwide to achieve their sustainability goals through the implementation of curated green technology projects that generate renewable energy, improve energy efficiencies, eliminate or reduce emissions, and sequester carbon directly from the air.”

It adds that it “also helps these organizations meet their net-zero goals by providing them access to high-quality carbon credits.”

In some cases, DEVS does this by partnering with companies that have technologies that are eligible for generating carbon credits, producing the credits on their behalf.

DevvStream then typically gets 25% of the credits that are generated for the life of the project. This is highly profitable since the company isn’t investing in the project itself.

It has announced several signed contracts with EV charging networks to help them generate carbon credits, including:

Texas-based Go-Station

New York City-based Green Energy Technology

India-based E-Fill Electric

Florida-based OK2Charge

The de-SPAC merger led to a major business development for DEVS: the establishment of a 50% equity stake in Monroe Sequestration Partners (MSP) and its carbon sequestration operations.

As DEVS explains, “MSP is working within the geographic area and geologic formations capable of carbon storage for a legacy oil and gas field — covering 425 square-miles across 3 parishes in northern Louisiana — to develop one of the largest carbon sequestration reservoirs in the United States, with an estimated total storage capacity of 260MMT of CO2, and capable of capturing a significant portion of the 30 million metric tons of CO2 emitted from local sources annually, generating up to 30 million carbon credits per year.”

DEVS expects the reservoir to be fully functional by 2027, and for revenues from the project “to be generated within a two-year timeframe via carbon credits and sequestration federal tax credits.” The tax credits alone are worth $85 per ton of CO2 sequestered, with a capacity of 260 million tons.

In May, DEVS revealed MSP had signed a Collaboration Agreement with Southern Energy under which Monroe would provide permanent CO₂ sequestration for Southern Energy’s proposed $1 billion methanol and sustainable aviation fuel facility in Louisiana.

Late last year, DEVS announced that it will be diversifying its revenue streams to include renewable energy certificates (I-RECs).

An I-REC is generated when a power plant generates 1MWh of renewable energy. It can then be sold to companies that need them to maintain their commitments to renewable energy.

These days, some of the largest companies in the world — heavyweights such as Apple, Google, Microsoft, and Samsung — have commitments to use 100% renewable energy, which often requires buying I-RECs.

DevvStream has secured exclusive agreements in Asia's renewable energy market:

Medellin Solar Power Facility (Philippines): A 730 MWp project capable of generating over 1.2 million I-RECs per year.

PT.Siteba Hydroelectric Facility (Indonesia): An already operational hydro facility expected to generate I-RECs in 2025

DEVS launched another very interesting project last December called “D-PIVOT.”

D-PIVOT “is a carbon offset tool designed specifically to enable eco-conscious consumers to counterbalance the emissions-related impacts associated with shipping their online purchases.”

It integrates directly with any Shopify storefront and allows customers to add carbon offsets from DEVS’ portfolio to any purchase. Here is its page in the Shopify app store.

The idea is to allow people who want to offset their carbon footprint to do so right at checkout.

In case you aren’t familiar, Shopify powers about 28% of all e-commerce stores in the U.S., and DEVS notes that D-PIVOT will give the company “a strong sales channel for its inventory of several million high-quality carbon credits.”

In March, the company announced that it will be partnering with Zing and Minimus Fulfillment, two “key players in the online retail ecosystem” to provide access to D-PIVOT to their clients. This should really help the company get the word out.

DEVS seems well connected in the “green” space, with CEO Sunny Trinh even speaking at a “high-level session” of the United Nations Science-Policy-Business Forum on the Environment in Nairobi, Kenya, last year.

In February, DEVS was admitted to the Singapore Carbon Market Alliance (SCMA).

The news that sent DEVS stock soaring in May was of a signed Memorandum of Understanding with Fayafi Investment Holding, “one of the UAE's most forward-thinking and diversified investment platforms.”

The agreement signaled the intent to launch “Fayafi x DevvStream Green Ventures” — a “global joint venture designed to accelerate investment in decarbonization and climate infrastructure projects worldwide.”

On June 20, the company announced another big partnership with Energy Efficient Technologies (EET), an engineering firm that reduces electricity use for large-scale clients including Marriott and Anheuser-Busch.

Under the agreement, DEVS “will receive revenue from EET's carbon credits and international renewable energy certificates ("I-RECs") and share in verified utility-bill savings.”

The company revealed a big development in July: It entered a securities purchase agreement for the issuance of up to (US)$300 million in Senior Notes with Helena Partners, with an initial funding of $10 million already in the bag.

The funding was to support a crypto strategy in which DEVS “will allocate 75% of the net proceeds (70% of the initial tranche) toward the purchase of liquid digital assets that offer 24/7 liquidity, serve as non-correlated stores of value, and may be used as collateral for future credit facilities.”

It announced the initial deployment on August 1 with purchases of Bitcoin and Solana, and by October 8, it said it held 22.229 BTC and 12,110 SOL (combined, worth approximately $3.7 million at this morning’s prices).

See this press release from November 6 for more on the company’s digital-asset and tokenization strategy going forward.

As you do your own research on this breakthrough company, be sure to check out its November 2024 investor presentation. I thought the company’s website was also very clear and helpful.

As always, be sure to approach your trading in a responsible manner. Trading is very risky, and nothing is ever guaranteed, so never trade with more than you can afford to lose.

Please read the full disclaimer at the bottom of this email as well so you are aware of our compensation and other conflicts of interest, as well as additional risks and considerations. Always have a well-thought-out game plan that takes your personal risk tolerance into consideration.

Bottom line: DEVS is one of the few pure-play carbon-credit companies to list on a major U.S. exchange, and it’s pursuing a parallel crypto treasury strategy

Previous alerts I’ve sent on it went on to surge 25%, 58%, and even 127% the days I sent them.

💥Tune in to see if we see another big move on DEVS today!

To Your Success,

*ISSUER PAID DISCLAIMER: This entity is owned by Sherwood Ventures LLC (SV). To more fully understand any SV subscription, website, application or other service, please review our full disclaimer located at https://bullseyealerts.com/disclaimer/

Just so you know, what you're reading is curated content for which we have received a monetary fee (detailed below) to create and distribute. Let's be clear that investing can be quite the roller coaster as stock prices can have wild swings up and down, so consider those crucial risks before you ever consider trading anything we discuss. Make sure you check out our full disclosure down below for the details on how we were paid, the risks, and why these results aren't what you'd call “typical.”

Just a quick heads up about this ad you're reading—as we’ve said, even though we like the company referenced above, and all the facts we discussed above are true to the best of our knowledge, we are running a business here. To distribute this information and help offset the costs of maintaining our large digital audience, in advance of writing the content above, we received forty thousand dollars (cash) from DevvStream Corp (paid via Shore Thing Media) for advertising DevvStream Corp for a three day marketing program on December 3, 2025. Previously, we received fifteen thousand dollars (cash) from Sica Media for advertising DevvStream Corp for a one day marketing program on July 31, 2025. Additionally, we received fifteen thousand dollars (cash) from Sica Media for advertising DevvStream Corp for a one day marketing program on July 21, 2025, and also twenty five thousand dollars (cash) from Legends Media for advertising DevvStream Corp for a one day marketing program on March 19, 2025. Prior to this, we received twenty five thousand dollars (cash) from Legends Media for advertising DevvStream Corp for a one day marketing program on February 3, 2025, and we also received twenty thousand dollars (cash) from Legends Media for advertising DevvStream Corp for a one day marketing program on November 29, 2024. To date, we have received a total of one hundred forty thousand dollars for advertising DevvStream Corp.

It might seem obvious, but while our client claims not to own any shares in DevvStream Corp, whoever ultimately paid them most likely owns shares. You should assume they are looking to sell some or all of them at any time after we send out this information, which might negatively affect the stock price. We may also buy or sell shares in the company at some point in the future, although neither Sherwood Ventures nor its owners own any shares of the company at this time. Also, keep in mind that due to the sheer size of our audience, if even a small percentage of people decide they want to buy this stock, it could potentially boost interest enough to hike up those share prices and cause a temporary spike, and the opposite is possible as the marketing campaign ends, though that is not always the case.

Now, diving right into DevvStream Corp might sound exciting. But remember, it’s like venturing into the wilderness—be aware that there's exceptional risk involved in trading. This isn't small potatoes we're talking about; you could lose every dime you put in, so always carefully think about what you’re doing. That’s why they call this trading, after all. We're shining a light on the good stuff about the company here, but it's on you to do your homework, make your own calls, and determine a plan for your own trading, hopefully with the help of your professional 1nvestment advis0r.

Oh, that brings us to another crucial point—we're not here to tell you (or even recommend) what you should do with your hard-earned money. We’re simply sharing our non-expert thoughts by highlighting some companies who are paying us and we like that could use some help telling their story to more people. We’re obviously biased in our writing. We’re not here to dig into anything that may be negative about the company; this is advertising, after all! Also, keep in mind that if we make some predictions about the future, these are technically known as “forward-L00king statements” under the securities acts, so take those with a grain of salt. As with all forecasts, they’re not set in stone, often wrong, and we certainly can’t know where the Company’s earnings, business, or share price will be tomorrow or a year from now.

Everything you read from us is all for your education, information, and possible entertainment. While we believe the info is reliable and accurate, we can't wear a cape and guarantee it. Before you jump into anything, make sure to talk it over with a pro—someone you trust who's licensed to give you real advice. To be clear,

Neither Sherwood Ventures nor its owners, employees, or independent contractors are registered as a securities broker-dealer, broker, 1nvest.ment advis0r (IA), or IA rep’s with the SEC, any state securities regulatory authority, or any self-regu1atory organization.

So, that's the scoop! If you're intrigued and want to learn more about the companies we talk about, hit up the SEC's website to dig into their filings and see the full picture.