- Bullseye Trades

- Posts

- My “tactical” idea of the day - HIT

My “tactical” idea of the day - HIT

Breakout earnings driving it higher

Sponsored by Primetime Profiles and Disseminated on Behalf of Health in Tech, Inc*

Markets are sleepy this morning, but my eye is on one small stock that just dropped some huge earnings numbers. It’s already been on a heater — and after that 86% revenue jump, things could get interesting very quickly.

TODAY’S TOP ALERT!

Health in Tech, Inc (Nasdaq: HIT)

👉 HIT is TODAY’S #1 ALERT 👈

Good morning, Folks,

Stock futures are basically flat this morning as investors hold their breath waiting for the Alphabet and Tesla earnings to drop tomorrow.

The trading week got off to a great start yesterday with the Nasdaq and S&P 500 both reaching new intraday highs, and the S&P 500 closing above 6,300 for the first time.

On the “tactical trading” front, I alerted one stock that went on to make a double-digit intraday gain and another that made a triple-digit move.

At its peak, it was up 132% intraday thanks to an announcement about a new crypto treasury strategy.

It fell back to earth by the close, but now I see it’s up 18% in the pre-market.

My “tactical trade” idea today is a small stock that’s riding the earnings wave this week. 🏄

After the bell yesterday, it dropped news of an 86% jump in year-over-year revenue for Q2 and a 134% increase in adjusted EBITDA.

Go ahead and pull up Health In Tech Inc. (HIT) on your favorite trading platform.

You’ll see that the stock has already had a huge runup since early April…

From its April 7 low, the stock climbed 150% into yesterday’s close — including a 16% jump yesterday in anticipation of earnings.

Investors responded very positively to the earnings news in after-hours trading and that continued into the pre-market this morning, so I’m watching the stock today for a serious spike.

👉 HIT is TODAY’S #1 ALERT 👈

Here's why this one could be primed for a tear…

HIT describes itself as “an insurance exchange platform revolutionizing the self-funded health care market.”

Self-funded health plans allow companies to pay claims directly, with stop-loss protection for big bills.

HIT has a proprietary platform that “streamlines complex underwriting, enhances transparency, and empowers every participant in the healthcare ecosystem.”

As you know, healthcare in the U.S. is dominated by big players like UnitedHealth, but upstarts like HIT are leveraging AI to potentially disrupt their business.

To date, the company is operating in 41 states with 942 business clients, 24,839 enrolled employees, and 778 brokers, Third-party Administrators (“TPAs”) and Additional Third-party Agencies.

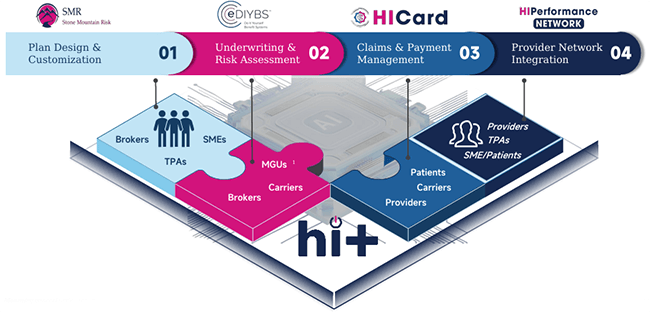

Here’s how their AI-powered model works:

Plan Design and Customization — Through its stop-loss arm Stone Mountain Risk, HIT “works with brokers, third-party administrators (TPAs), and healthcare vendors to create customized health plans tailored to each small employer’s needs.”

Underwriting and Risk Assessment — The company’s proprietary eDIYBS (e- Do It Yourself Benefits) platform turns weeks into minutes with “the only online, fully autonomous self-funded quoting platform available for brokers, [Managing General Underwriters], TPAs, and more.”

Claims and Payment Management — HIT’s proprietary HI Card technology is “a single standardized transaction platform for providers, payers, and patients alike.”

Provider Network Integration — The company’s HI Performance Network allows Medicare-based reimbursement pricing across 50 states, 8,800+ hospitals, and 1.4+ million provider locations.

I’m not an expert on health plans/insurance, so for me, the most important thing is the company’s balance sheet…

In 2024, total revenue hit $19.5 million with net income of $670,000 — a positive bottom line.

But it’s in 2025 that things have really taken off.

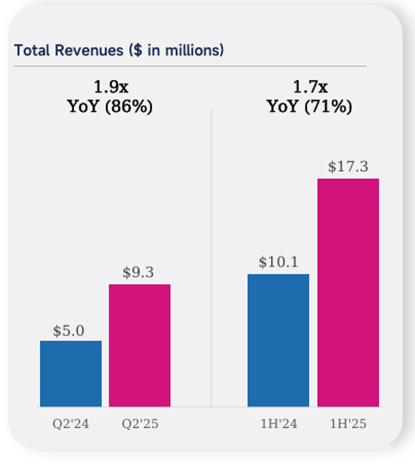

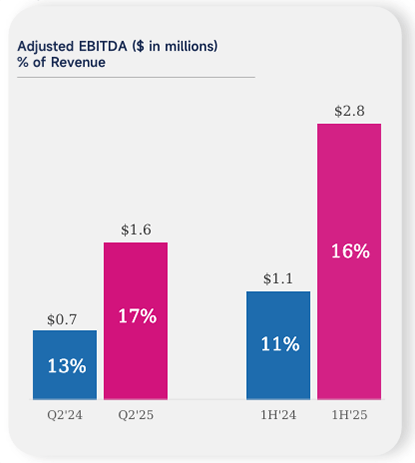

Just after the bell yesterday, HIT released its Q2 earnings. Total revenue reached $9.3 million — up 86% year over year — and net income was $338,000.

For the first half of 2025, we’re looking at revenues of $17.3 million — nearly equal to the entirety of 2024. Adjusted EBITDA was $2.8 million — 1.2x the figure for 2024.

All of this was thanks to a 5,738 increase in the number of billed employees compared to this time last year.

These are huge increases for a company that has been around since 2014.

In April, HIT’s CEO Tim Johnson appeared on The Street Report podcast — which you can listen to here — to discuss the company and its rapid revenue growth.

In June, Chief Growth Officer Dustin Plantholt was interviewed live from the NYSE on New to The Street, which airs on Bloomberg TV.

And just five days ago, the Maxim Group reiterated a $2.50 price target — 85% upside from yesterday’s closing price.

Be sure to do your own homework on HIT. You’ll for sure want to check out the company’s accessible investor presentation and its website.

As always, be sure to approach your trading in a responsible manner. Trading is very risky, and nothing is ever guaranteed, so never trade with more than you can afford to lose.

Please read the full disclaimer at the bottom of this email as well so you are aware of additional risks and considerations. Always have a well-thought-out game plan that takes your personal risk tolerance into consideration.

Bottom line: HIT’s financials had already been solid, but after hours yesterday it announced an 86% year-over-year increase in Q2 revenue and a 134% hike in adjusted EBITDA.

Investors clearly liked what they saw after hours and in the pre-market, so I’m watching HIT today for some serious price action.

Keep HIT at the top of your radar to watch it all play out!

To Your Success,

Questions or concerns about our products? Email [email protected] © Copyright 2022, RagingBull

*DISCLAIMER: This entity is owned by Sherwood Ventures LLC (SV). To more fully understand any SV subscription, website, application or other service, please review our full disclaimer located at https://bullseyealerts.com/disclaimer/

Just so you know, what you're reading is curated content for which we have received a monetary fee (detailed below) to create and distribute. Let's be clear that investing can be quite the roller coaster as stock prices can have wild swings up and down, so consider those crucial risks before you ever consider trading anything we discuss. Make sure you check out our full disclosure down below for the details on how we were paid, the risks, and why these results aren't what you'd call “typical.”

Just a quick heads up about this ad you're reading—as we’ve said, even though we like the company referenced above, and all the facts we discussed above are true to the best of our knowledge, we are running a business here. To distribute this information and help offset the costs of maintaining our large digital audience, in advance of writing the content above, we received twenty five thousand dollars (cash) from Primetime Profiles for advertising Health in Tech, Inc for a one day marketing program starting on July 22, 2025. It might seem obvious, but while our client claims not to own any shares in Health in Tech, Inc, whoever ultimately paid them most likely owns shares. You should assume they are looking to sell some or all of them at any time after we send out this information, which might negatively affect the stock price. We may also buy or sell shares in the company at some point in the future, although neither Sherwood Ventures nor its owners own any shares of the company at this time. Also, keep in mind that due to the sheer size of our audience, if even a small percentage of people decide they want to buy this stock, it could potentially boost interest enough to hike up those share prices and cause a temporary spike, and the opposite is possible as the marketing campaign ends, though that is not always the case.

Now, diving right into Health in Tech, Inc might sound exciting. But remember, it’s like venturing into the wilderness—be aware that there's exceptional risk involved in trading. This isn't small potatoes we're talking about; you could lose every dime you put in, so always carefully think about what you’re doing. That’s why they call this trading, after all. We're shining a light on the good stuff about the company here, but it's on you to do your homework, make your own calls, and determine a plan for your own trading, hopefully with the help of your professional 1nvestment advis0r.

Oh, that brings us to another crucial point—we're not here to tell you (or even recommend) what you should do with your hard-earned money. We’re simply sharing our non-expert thoughts by highlighting some companies who are paying us and we like that could use some help telling their story to more people. We’re obviously biased in our writing. We’re not here to dig into anything that may be negative about the company; this is advertising, after all! Also, keep in mind that if we make some predictions about the future, these are technically known as “forward-L00king statements” under the securities acts, so take those with a grain of salt. As with all forecasts, they’re not set in stone, often wrong, and we certainly can’t know where the Company’s earnings, business, or share price will be tomorrow or a year from now.

Everything you read from us is all for your education, information, and possible entertainment. While we believe the info is reliable and accurate, we can't wear a cape and guarantee it. Before you jump into anything, make sure to talk it over with a pro—someone you trust who's licensed to give you real advice. To be clear,

Neither Sherwood Ventures nor its owners, employees, or independent contractors are registered as a securities broker-dealer, broker, 1nvest.ment advis0r (IA), or IA rep’s with the SEC, any state securities regulatory authority, or any self-regu1atory organization.

So, that's the scoop! If you're intrigued and want to learn more about the companies we talk about, hit up the SEC's website to dig into their filings and see the full picture.