- Bullseye Trades

- Posts

- Robots Later... Momentum Now 🤖💸

Robots Later... Momentum Now 🤖💸

[Inside] Today’s game plan

Sponsored by Primetime Profiles and Disseminated on Behalf of Sadot Group, Inc*

The big guys like Tesla report tonight, but I’m tracking a small-cap today that’s already making serious moves. It’s got momentum, real earnings, and a backstory you wouldn’t expect.

TODAY’S TOP ALERT!

Sadot Group, Inc (Nasdaq: SDOT)

👉 SDOT is TODAY’S #1 ALERT 👈

Good morning, Folks,

I’m expecting a relatively slow day today in the markets — at least between the bells…

The real action will take place after hours when Alphabet and Tesla release their earnings.

As a frequent Tesla trader, I’m usually pretty bearish around earnings, but this time I’m not. I think the bad news is baked in and Elon will impress us with something huge around robots, robotaxis, new Teslas, AI, etc.

But as the day unfolds, I’ll have my focus on much smaller stocks.

Yesterday, my “tactical trade” idea crushed it — hitting a 74% intraday high before closing the day up 25%.

I’m now 15-for-20 on recent ideas that surged 10%+ the days I alerted them.

Today’s idea is a big momentum play.

Have a look at Sadot Group Inc. (SDOT) on your trading platform.

The stock has been on a tear really since June, but its latest inflection began last Monday.

From its low that day, the stock is up 40%. Yesterday alone, it notched up 18%.

As I’ll discuss, there are a lot of reasons for investors to be excited. I’m watching this one like a hawk today to see if its momentum keeps up.

👉 SDOT is TODAY’S #1 ALERT 👈

Here’s why I think this one is on such a tear…

SDOT came into its present form in 2022 via an agreement with the company’s legacy entity, Muscle Maker Inc., and Aggia FZ LLC, “a global supply chain consulting operation based in Dubai.”

Muscle Maker was a publicly traded company that operated Pokémoto and Muscle Maker Grill restaurant chains.

These days, SDOT describes itself as “an emerging global agri-commodities supply chain organization with farming, origination & trading operations located worldwide.”

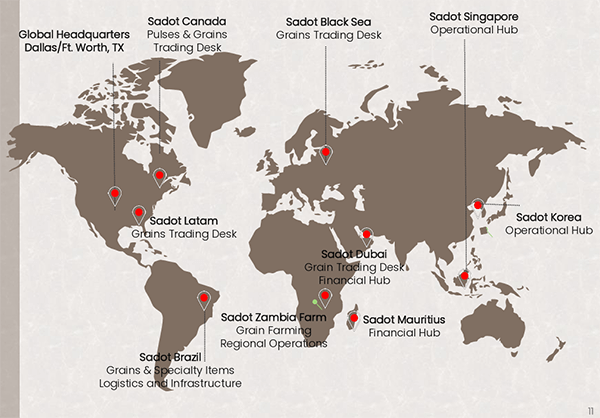

It has three main arms:

Farm Operations - “Building out operations to provide leverage to trading operations.”

Origination and Trading Operations - “Sourcing, buying and selling a wide variety of agri-commodities worldwide.”

Legacy Food Service Operations - “Actively engaged in the review of potential sales opportunities for Pokémoto and Muscle Maker Grill.”

Here are the top 5 things to know about the company:

1. From Muscle Maker to Global Agri-Trade Beast 🌾

At its peak, Muscle Maker Grill had more than 50 locations and Pokémoto had more than 30.

The restaurants are ultimately a distraction for SDOT and are a drag on its balance sheet.

Zacks Small-Cap Research pointed out in March that “Management stated there are currently multiple parties engaging in due diligence to potentially acquire these restaurants.”

Now the company will be able to focus on building a global food supply chain empire across North America, South America, Africa, and Asia.

2. Strategic Global Expansions — Brazil, Canada, S. Korea 🇧🇷 🇨🇦 🇰🇷

Brazil: Launched Sadot Brasil in January 2024 to “source and export grains such as soybean, soybean meal, wheat and corn.”

Canada: Established Sadot Canada Inc. in July 2024 to “originate and trade Canadian grains, oilseeds and pulses to customers worldwide.”

South Korea: Established Sadot Korea — the company’s first Asian subsidiary — in March 2025 to “empower Korean agriculture,” “expand agri-commodity trading,” and “leverage financial opportunities.”

3. Fresh Leadership Shake-Up ⚡

SDOT has recently appointed a new CEO and a new Chairman of the Board:

Chagay Ravid was appointed CEO on May 28. He “brings a wealth of experience in capital markets having led for 15 years the most active mid market investment bank in Israel www.cukierman.co.il. Mr. Ravid was engaged in over $10 billion transaction values…”

Claudio Torres was appointed Chairman of the Board on June 24. He “brings over 30 years of leadership across the global agriculture, food production, and supply chain sectors-including executive roles at industry powerhouses such as Monsanto, Syngenta, and Advanta Seeds.”

4. Q1 2025 Earnings Show Real Traction 📈

SDOT delivered some seriously impressive numbers for Q1 2025:

Consolidated revenues of $132.2 million — a 24% jump from the prior period

Net income of $0.9 million — a $1.2 million increase from Q1 2024

EBITDA of $2.5 million — a $2.5 million improvement from Q1 2024

Working capital surplus of $21.9 million — up from $20.5 million as of December 31, 2024

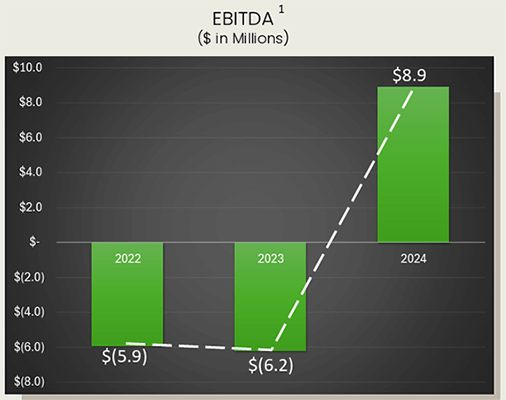

5. 2024 Marked Its First-Ever Yearly Positive Net Income 💰

Last year was a serious financial turnaround for SDOT:

And that’s with the legacy restaurant business dragging it down.

The company also hit a net income of $4.0 million — up significantly from its $7.8 million loss in 2023. This marked its “first ever full year positive net income in the history of the company.”

Final Thoughts

SDOT is reporting some very impressive numbers for a company of its size (an $11.1 million market cap)...

It’s no wonder Zacks Small-Cap Research said in March, “we believe SDOT could be worth $15.00 per share over the long-term.” That would be a 737% increase over yesterday’s closing price.

To find out more about its financials and what it’s up to, check out this Q1 earnings webcast as well as this April 2025 investor presentation and the company website.

As always, be sure to approach your trading in a responsible manner. Trading is very risky, and nothing is ever guaranteed, so never trade with more than you can afford to lose.

Please read the full disclaimer at the bottom of this email as well so you are aware of additional risks and considerations. Always have a well-thought-out game plan that takes your personal risk tolerance into consideration.

Bottom line: SDOT is up 40% over the past week and 18% yesterday alone…

Tune in today to see if that momentum carries SDOT even higher!

To Your Success,

Jeff Bishop

P.S. Make sure you join me and over 1000 traders in the Market Master’s trading room today for live trading signals and education. You can access it at no cost right now.

Questions or concerns about our products? Email [email protected] © Copyright 2022, RagingBull

*DISCLAIMER: This entity is owned by Sherwood Ventures LLC (SV). To more fully understand any SV subscription, website, application or other service, please review our full disclaimer located at https://bullseyealerts.com/disclaimer/

Just so you know, what you're reading is curated content for which we have received a monetary fee (detailed below) to create and distribute. Let's be clear that investing can be quite the roller coaster as stock prices can have wild swings up and down, so consider those crucial risks before you ever consider trading anything we discuss. Make sure you check out our full disclosure down below for the details on how we were paid, the risks, and why these results aren't what you'd call “typical.”

Just a quick heads up about this ad you're reading—as we’ve said, even though we like the company referenced above, and all the facts we discussed above are true to the best of our knowledge, we are running a business here. To distribute this information and help offset the costs of maintaining our large digital audience, in advance of writing the content above, we received twenty five thousand dollars (cash) from Primetime Profiles for advertising Sadot Group, Inc for a one day marketing program starting on July 23, 2025. It might seem obvious, but while our client claims not to own any shares in Sadot Group, Inc, whoever ultimately paid them most likely owns shares. You should assume they are looking to sell some or all of them at any time after we send out this information, which might negatively affect the stock price. We may also buy or sell shares in the company at some point in the future, although neither Sherwood Ventures nor its owners own any shares of the company at this time. Also, keep in mind that due to the sheer size of our audience, if even a small percentage of people decide they want to buy this stock, it could potentially boost interest enough to hike up those share prices and cause a temporary spike, and the opposite is possible as the marketing campaign ends, though that is not always the case.

Now, diving right into Sadot Group, Inc might sound exciting. But remember, it’s like venturing into the wilderness—be aware that there's exceptional risk involved in trading. This isn't small potatoes we're talking about; you could lose every dime you put in, so always carefully think about what you’re doing. That’s why they call this trading, after all. We're shining a light on the good stuff about the company here, but it's on you to do your homework, make your own calls, and determine a plan for your own trading, hopefully with the help of your professional 1nvestment advis0r.

Oh, that brings us to another crucial point—we're not here to tell you (or even recommend) what you should do with your hard-earned money. We’re simply sharing our non-expert thoughts by highlighting some companies who are paying us and we like that could use some help telling their story to more people. We’re obviously biased in our writing. We’re not here to dig into anything that may be negative about the company; this is advertising, after all! Also, keep in mind that if we make some predictions about the future, these are technically known as “forward-L00king statements” under the securities acts, so take those with a grain of salt. As with all forecasts, they’re not set in stone, often wrong, and we certainly can’t know where the Company’s earnings, business, or share price will be tomorrow or a year from now.

Everything you read from us is all for your education, information, and possible entertainment. While we believe the info is reliable and accurate, we can't wear a cape and guarantee it. Before you jump into anything, make sure to talk it over with a pro—someone you trust who's licensed to give you real advice. To be clear,

Neither Sherwood Ventures nor its owners, employees, or independent contractors are registered as a securities broker-dealer, broker, 1nvest.ment advis0r (IA), or IA rep’s with the SEC, any state securities regulatory authority, or any self-regu1atory organization.

So, that's the scoop! If you're intrigued and want to learn more about the companies we talk about, hit up the SEC's website to dig into their filings and see the full picture.