- Bullseye Trades

- Posts

- This pivot has traders *very excited* 🕺

This pivot has traders *very excited* 🕺

A 77% rally since early December...

Issuer-Sponsored Content from Axe Compute, Inc*

Everyone likes a good comeback story… This stock hit a clean bottom in early December and hasn’t looked back since. The shift behind the scenes is what has me paying attention.

TODAY’S TOP ALERT!

Axe Compute (Nasdaq: AGPU)

👉 AGPU is TODAY’S #1 ALERT* 👈

Good morning, Folks, Jeff Bishop here,

There’s a lot of noise out there right now, with earnings, CPI and PPI data, and now jobless claims data pouring in… not to mention the President mixing things up as usual.

The macro environment is important, but it pays to stay focused. Yesterday was a perfect example…

I was locked into a stock that had surged the day before despite market headwinds. That surge was the culmination of a 146% rally since Christmas Day.

Insiders were buying up shares and there was a lot of online chatter. Something was clearly in the works.

What ended up playing out yesterday one of the most impressive stock moves I’ve come across, much less alerted:

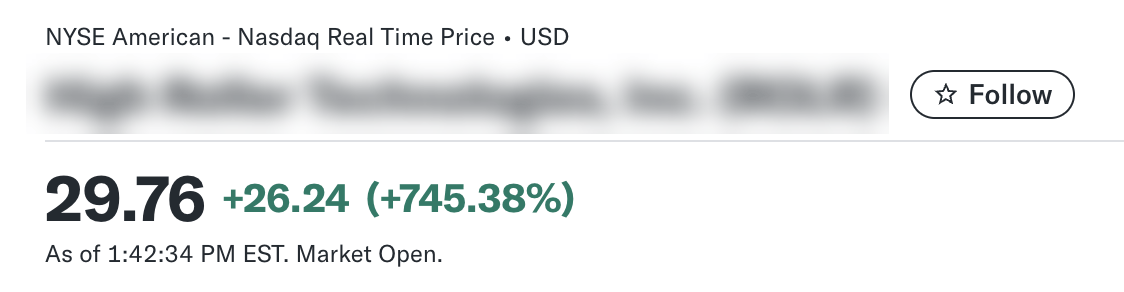

The stock’s peak move was actually 856%, making it nearly a ten-bagger on a straight penny-stock play… all in a single day.

It wound up closing the day at 436% and it’s up 27% in the pre-market as of this writing.

It was an incredible move to watch, and I hope you followed from when I alerted you to the stock.

Today I’m pivoting to a company that shifted its strategy late last year in a way that has started to pay off with investors…

Have a look at the chart for Axe Compute Inc. (AGPU) and the first thing you’ll notice is that despite some notable runups along the way, the stock got hammered most of last year.

Then something changed in early December…

On December 5, AGPU hit a clean bottom and began a sharp bounce. It’s now up 77% from its low that day.

The stock has been reliably stair-stepping higher, and yesterday it dipped 5% — closing at $6.86 after hitting $7.44 intraday.

There’s really solid action in the pre-market this morning, and if we see a move above $7.44, we could be back to the races.

Dial into AGPU today to see how this one plays out!

👉 AGPU is TODAY’S #1 ALERT *👈

For years, the company operated under the name Predictive Oncology (ticker POAI). It was focused on AI-driven drug discovery and cancer research.

The idea was to use machine learning and big datasets to speed up drug development, but the business never really took off.

That legacy business still exists, and management is continuing to run that side of things…

But the big realization seems to have been found in the bottleneck of its operations: compute.

That’s where AGPU’s pivot comes in.

On September 29, the company announced private placements of $344 million to “support its adoption of a digital asset treasury strategy under which the principal holding will be ATH, the native utility token of the Aethir ecosystem.”

The placements closed October 8, and on October 14, the company revealed “Shawn Matthews, CEO of DNA Holdings Venture, Inc., (the PIPE investor) and former CEO of investment bank Cantor Fitzgerald, has joined its Board of Directors; Thomas McLaughlin, CIO of DNA Holdings Venture, Inc., has joined the leadership team as Chief Investment Officer.”

On November 14, AGPU reported that as of November 10, it held approximately 5.70 billion ATH with a market value of approximately $152.8 million at the time.

This marked a clear alignment with Aethir, a decentralized GPU compute network that aims to solve one of the biggest problems in AI right now…

As it stands, the big cloud providers are expensive, backlogged, and inflexible.

Aethir’s approach is to aggregate GPUs from providers around the world and allow access to them as a decentralized network.

The system runs on its native token, ATH, which is used to pay for compute, reserve capacity, and incentivize hardware providers.

On December 12, AGPU revealed its new game plan…

It changed its name to Axe Compute and said it would “expand its business into high-performance enterprise AI infrastructure, addressing rising global demand for predictable, scalable compute capacity across enterprise AI workloads.”

The idea is to act as a bridge between businesses that need GPU power and the Aethir network that can supply it…

That means leveraging its hoard of ATH to lease GPU capacity, offer managed compute services, and help customers run large AI workloads.

This venture into “high-performance enterprise AI infrastructure” is tied to one of the most obvious bottlenecks in tech today, and that’s what has investors excited…

With the stock’s 77% runup since December 5, investors are starting to value the company as an AI infrastructure play rather than a struggling AI-driven biotech.

At its core, the company now has something for investors to sink their teeth into, and that’s why I’m watching AGPU closely right now.

As you do your own research, definitely check out the December 12 press release outlining AGPU’s new business strategy, as well as its customer-facing website here.

As always, be sure to approach your trading in a responsible manner. Trading is very risky, and nothing is ever guaranteed, so never trade with more than you can afford to lose.

Please read the full disclaimer at the bottom of this email as well so you are aware of our compensation and other conflicts of interest, as well as additional risks and considerations. Always have a well-thought-out game plan that takes your personal risk tolerance into consideration.

Bottom line: AGPU has “bottom-bounced” 77% since December 5 on optimism about the company’s venture into compute-for-hire services.

The stock dipped 5% yesterday but is showing a lot of promise in the pre-market this morning.

💥Tune into AGPU today to see where the momentum takes it!

To Your Success,

Jeff Bishop

P.S. Make sure you join me and over 1000 traders in the Market Master’s trading room today for live trading signals and education. You can access it at no cost right now.

*ISSUER-SPONSORED DISCLAIMER: This entity is owned by Sherwood Ventures LLC (SV). To more fully understand any SV subscription, website, application or other service, please review our full disclaimer located at https://bullseyealerts.com/disclaimer/

Just so you know, what you're reading is curated content for which we have received a monetary fee (detailed below) to create and distribute. Let's be clear that investing can be quite the roller coaster as stock prices can have wild swings up and down, so consider those crucial risks before you ever consider trading anything we discuss. Make sure you check out our full disclosure down below for the details on how we were paid, the risks, and why these results aren't what you'd call “typical.”

Just a quick heads up about this ad you're reading—as we’ve said, even though we like the company referenced above, and all the facts we discussed above are true to the best of our knowledge, we are running a business here. To distribute this information and help offset the costs of maintaining our large digital audience, in advance of writing the content above, we received thirty five thousand dollars (cash) from Axe Compute Inc. (via Sica Media) for a one day marketing program starting on January 15, 2026.

It might seem obvious, but while our client claims not to own any shares in Axe Compute Inc., whoever ultimately paid them most likely owns shares. You should assume they are looking to sell some or all of them at any time after we send out this information, which might negatively affect the stock price. We may also buy or sell shares in the company at some point in the future, although neither Sherwood Ventures nor its owners own any shares of the company at this time. Also, keep in mind that due to the sheer size of our audience, if even a small percentage of people decide they want to buy this stock, it could potentially boost interest enough to hike up those share prices and cause a temporary spike, and the opposite is possible as the marketing campaign ends, though that is not always the case.

Now, diving right into Axe Compute Inc. might sound exciting. But remember, it’s like venturing into the wilderness—be aware that there's exceptional risk involved in trading. This isn't small potatoes we're talking about; you could lose every dime you put in, so always carefully think about what you’re doing. That’s why they call this trading, after all. We're shining a light on the good stuff about the company here, but it's on you to do your homework, make your own calls, and determine a plan for your own trading, hopefully with the help of your professional 1nvestment advis0r.

Oh, that brings us to another crucial point—we're not here to tell you (or even recommend) what you should do with your hard-earned money. We’re simply sharing our non-expert thoughts by highlighting some companies who are paying us and we like that could use some help telling their story to more people. We’re obviously biased in our writing. We’re not here to dig into anything that may be negative about the company; this is advertising, after all! Also, keep in mind that if we make some predictions about the future, these are technically known as “forward-L00king statements” under the securities acts, so take those with a grain of salt. As with all forecasts, they’re not set in stone, often wrong, and we certainly can’t know where the Company’s earnings, business, or share price will be tomorrow or a year from now.

Everything you read from us is all for your education, information, and possible entertainment. While we believe the info is reliable and accurate, we can't wear a cape and guarantee it. Before you jump into anything, make sure to talk it over with a pro—someone you trust who's licensed to give you real advice. To be clear, neither Sherwood Ventures nor its owners, employees, or independent contractors are registered as a securities broker-dealer, broker, 1nvest.ment advis0r (IA), or IA rep’s with the SEC, any state securities regulatory authority, or any self-regu1atory organization.

So, that's the scoop! If you're intrigued and want to learn more about the companies we talk about, hit up the SEC's website to dig into their filings and see the full picture.